End-to-End AI-Powered AML Risk Platform

Oscilar provides a comprehensive solution that covers your entire AML needs—from customer onboarding to transaction monitoring and regulatory reporting. Our AI-powered platform is designed for both sponsor banks and fintechs, offering a flexible and scalable approach to compliance.

Request a Demo

Trusted by world-class banks and fintechs

Trusted by world-class banks and fintechs

Trusted by world-class banks and fintechs

Why Sponsor Banks & Fintechs Choose Oscilar?

Easy Setup & Seamless Integrations

Streamline implementation with easy data ingestion and pre-built KYC, KYB, and CDD integrations.

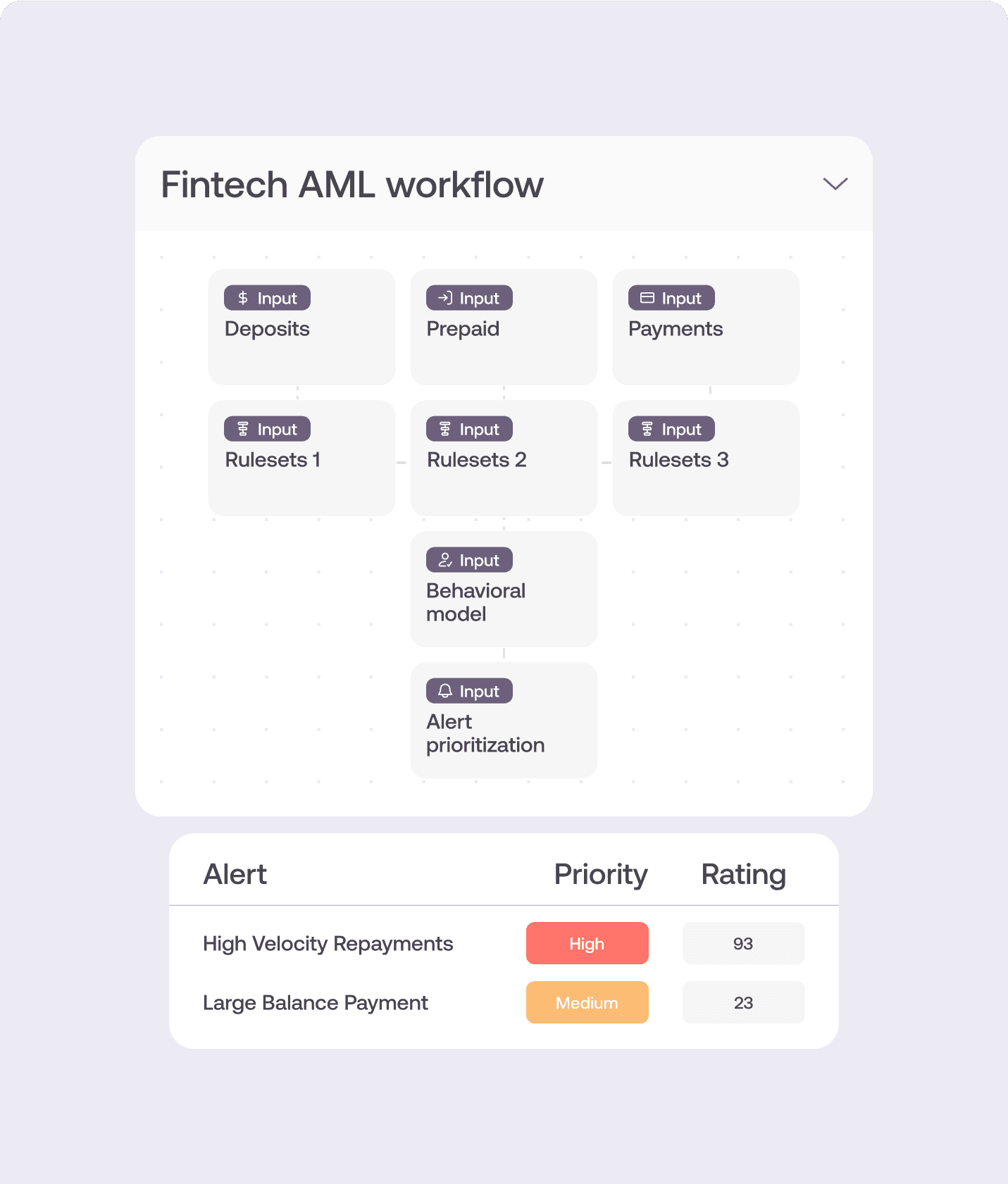

Leverage out-of-the-box AML scenarios and rule templates tailored for diverse customers and regions.

Real-Time AML Detection and Reduced False Positives

Prioritize critical AML alerts with AI-driven models to facilitate response management.

Detect hidden patterns of illicit activity through unsupervised anomaly detection and other techniques.

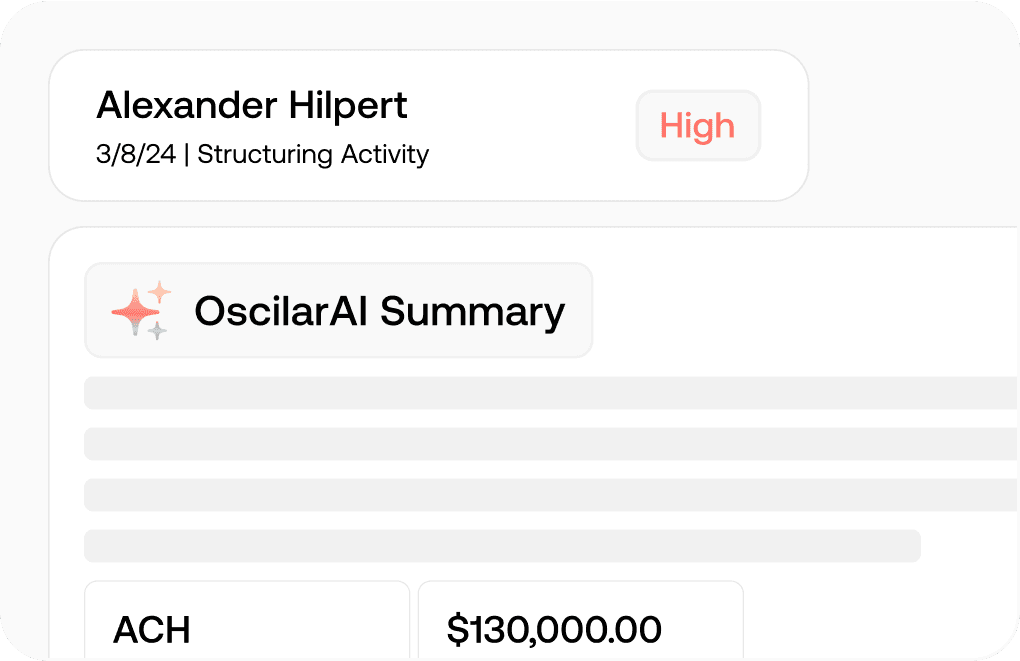

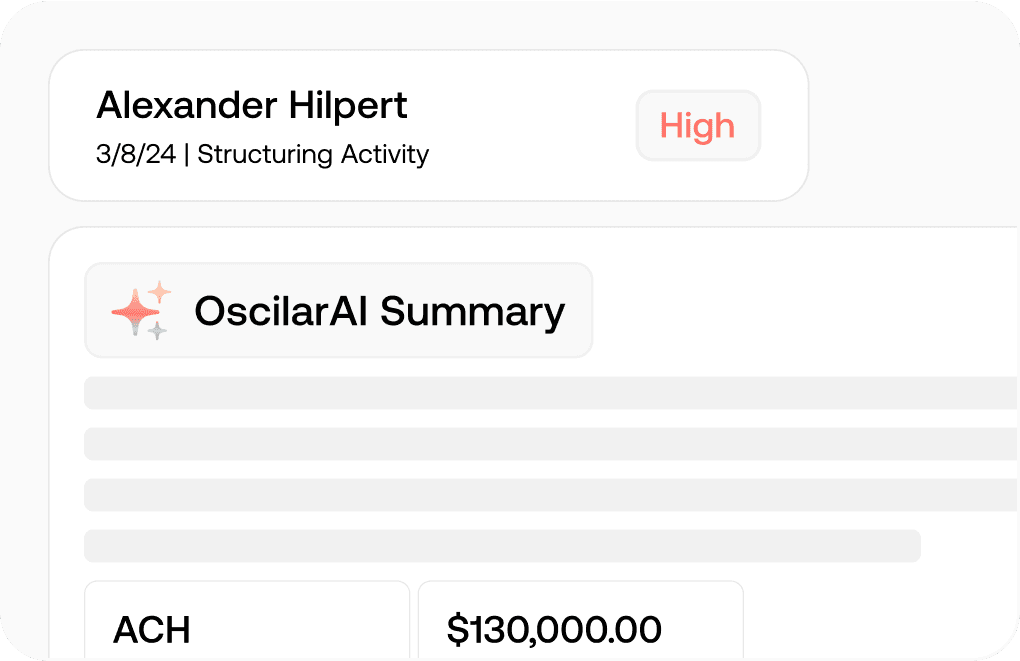

Smart Case Management & Reporting

Speed up reviews with a complete 360 view of each case and AI-powered summaries and narratives.

Leverage smart automations to assign cases, prioritize them, and escalate them.

Save countless hours with 1-click SAR reporting and filing.

Ease of Use & Seamless Integrations

Streamline onboarding with pre-built KYC, KYB, and CDD integrations, while leveraging out-of-the-box AML scenarios and rule templates tailored for diverse customers and regions.

Real-Time AML

Fraud Detection

Prioritize critical alerts with AI-driven models to boost response efficiency while detecting hidden patterns of illicit activity through unsupervised anomaly detection.

Smart Case Management & Reporting

Prioritize and assign tasks efficiently, view all relevant information in one place, and leverage AI-generated summaries—while streamlining SAR reporting and escalations with a single click.

Oscilar is the most comprehensive AI Risk Decisioning™ platform to manage AML compliance risk, as well as onboarding, fraud and credit risk.

Compliance

Onboarding

Fraud

Credit

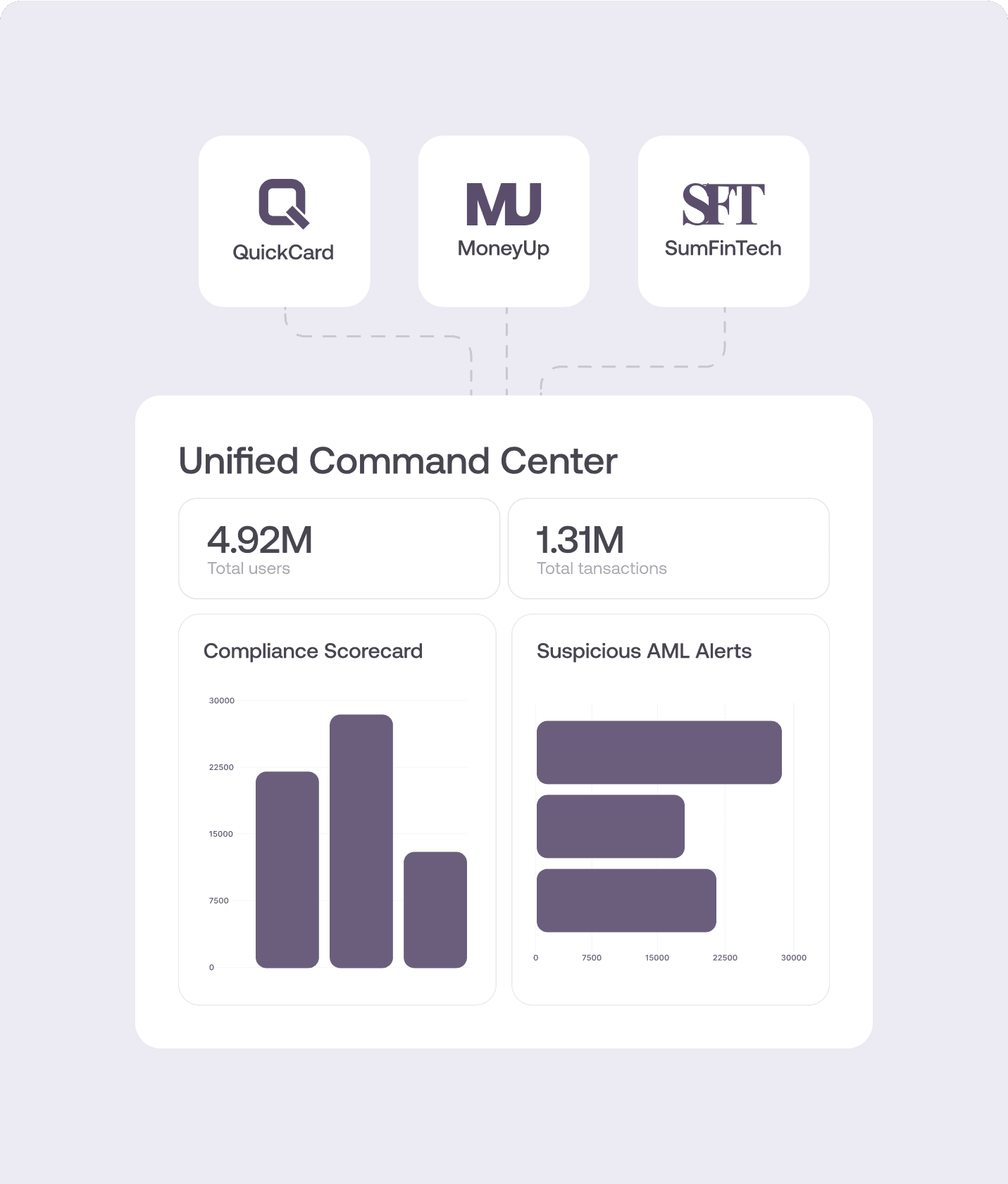

Gain full oversight and control over your fintech programs, addressing their unique risk profiles. Leverage AI to reduce false positives and prioritize key alerts and cases. Uplevel your compliance operations and accelerate investigations, SAR filing, reporting and governance.

Oscilar is the most comprehensive AI Risk Decisioning™ platform to manage AML compliance risk, as well as onboarding, fraud and credit risk.

Compliance

Onboarding

Fraud

Credit

Gain full oversight and control over your fintech programs, addressing their unique risk profiles. Leverage AI to reduce false positives and prioritize key alerts and cases. Uplevel your compliance operations and accelerate investigations, SAR filing, reporting and governance.

Oscilar is the most comprehensive AI Risk Decisioning™ platform to manage AML compliance risk, as well as onboarding, fraud and credit risk.

Compliance

Onboarding

Fraud

Credit

Gain full oversight and control over your fintech programs, addressing their unique risk profiles. Leverage AI to reduce false positives and prioritize key alerts and cases. Uplevel your compliance operations and accelerate investigations, SAR filing, reporting and governance.

Oscilar is the most comprehensive AI Risk Decisioning™ platform to manage AML compliance risk, as well as onboarding, fraud and credit risk.

Compliance

Onboarding

Fraud

Credit

Gain full oversight and control over your fintech programs, addressing their unique risk profiles. Leverage AI to reduce false positives and prioritize key alerts and cases. Uplevel your compliance operations and accelerate investigations, SAR filing, reporting and governance.

We were extremely impressed by Oscilar's capabilities from the moment we saw them. Their technology presented exactly what we needed in-house to support our growth ambitions while maintaining control. What really impressed us was Oscilar's agility and adaptability. The ability to enhance and refine our processes quickly, especially in monitoring, is crucial. With Oscilar, we can update rules and implement changes faster than with any other platform we've seen. This responsiveness is invaluable, particularly when it comes to adapting to new regulations. Oscilar is a fintech company doing things the right way, giving us the tools we need to grow confidently in this rapidly changing space.

Michael Kozub

CEO

We were extremely impressed by Oscilar's capabilities from the moment we saw them. Their technology presented exactly what we needed in-house to support our growth ambitions while maintaining control. What really impressed us was Oscilar's agility and adaptability. The ability to enhance and refine our processes quickly, especially in monitoring, is crucial. With Oscilar, we can update rules and implement changes faster than with any other platform we've seen. This responsiveness is invaluable, particularly when it comes to adapting to new regulations. Oscilar is a fintech company doing things the right way, giving us the tools we need to grow confidently in this rapidly changing space.

Michael Kozub

CEO