AI-Powered Credit Decisioning

Make smarter and more accurate credit decisions. Empower your risk and credit teams to operate autonomously and increase approval rates by leveraging one-click integrations, an intuitive no-code interface, and Oscilar AI.

Request a Demo

Create powerful credit risk workflows with Oscilar AI.

Create Entire Workflows Automatically

Describe your workflow logic in natural language and watch it come to life.

Generate Step Logic Seamlessly

Describe rule evaluation logic in natural language and let Oscilar AI generate complex expressions.

Obtain a true 360 degree view of your users and transactions.

One-Click Connection

Connect your own databases in one click with our powerful and automated database ingestion system.

Oscilar Marketplace

Seamlessly connect to 3rd party data sources by leveraging our 80+ partner marketplace.

Increase approval rates without increasing risk.

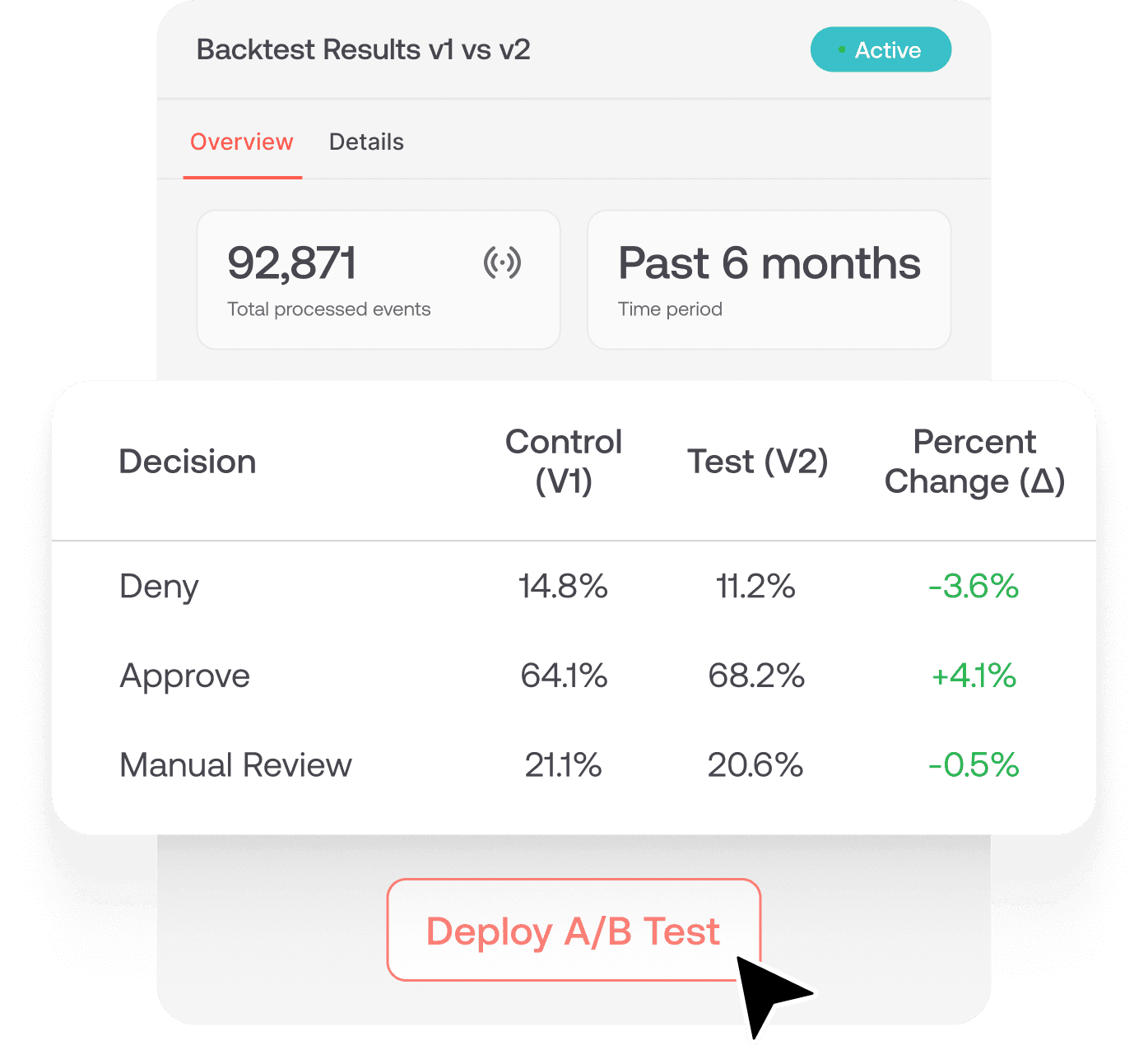

Backtest Historical Data

Run backtests in one click to validate new credit policies with historical data before deploying them.

A/B Test Easily

Test model performance change on multiple versions of the model with a single click.

Monitor Preferred KPIs

Manage approval rates, default rates and your own custom KPIs with a strong analytics suite.

Leverage the most advanced credit ML models in the industry.

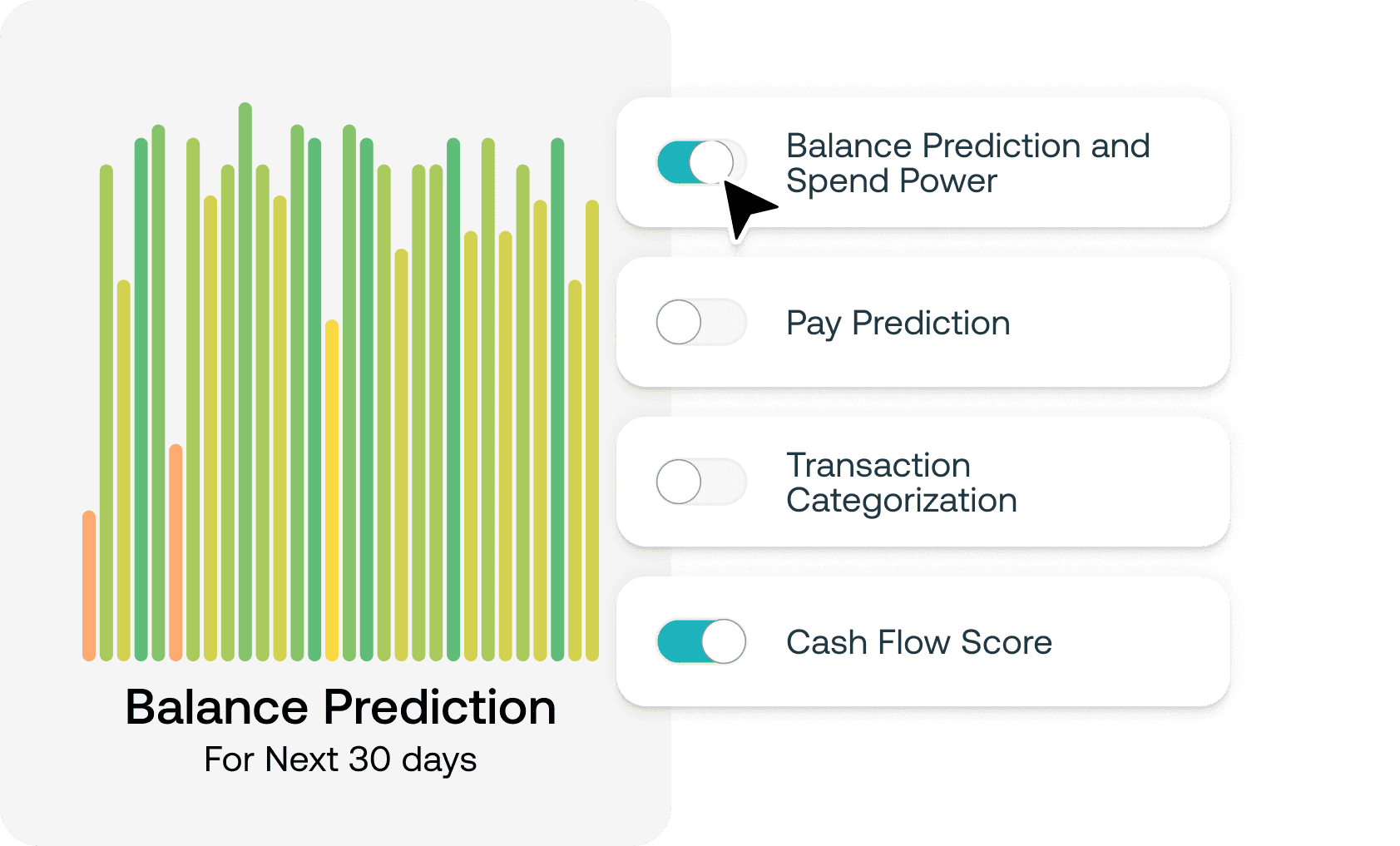

Balance Prediction & Spend Power

Predict business bank balance and spend power by leveraging cash flow data and 3rd party data.

Transaction Categorization

Categorize business transactions into custom or pre-defined categories (eg. rent, gambling, credit card payment, etc.).

See Oscilar in action.

Contact Sales →