Oscilar vs. NICE Actimize

End-to-End AI-Powered AML Risk Platform

Oscilar provides a comprehensive solution that covers your entire AML needs—from customer onboarding to transaction monitoring and regulatory reporting. Our AI-powered platform is designed for both sponsor banks and fintechs, offering a flexible and scalable approach to compliance.

Request a Demo

Easy Setup & Seamless Integrations

Streamline implementation in one click with our powerful and automated data ingestion system and pre-built KYC, KYB, and CDD integrations.

Real-Time FRAML Detection to Reduce False Positives

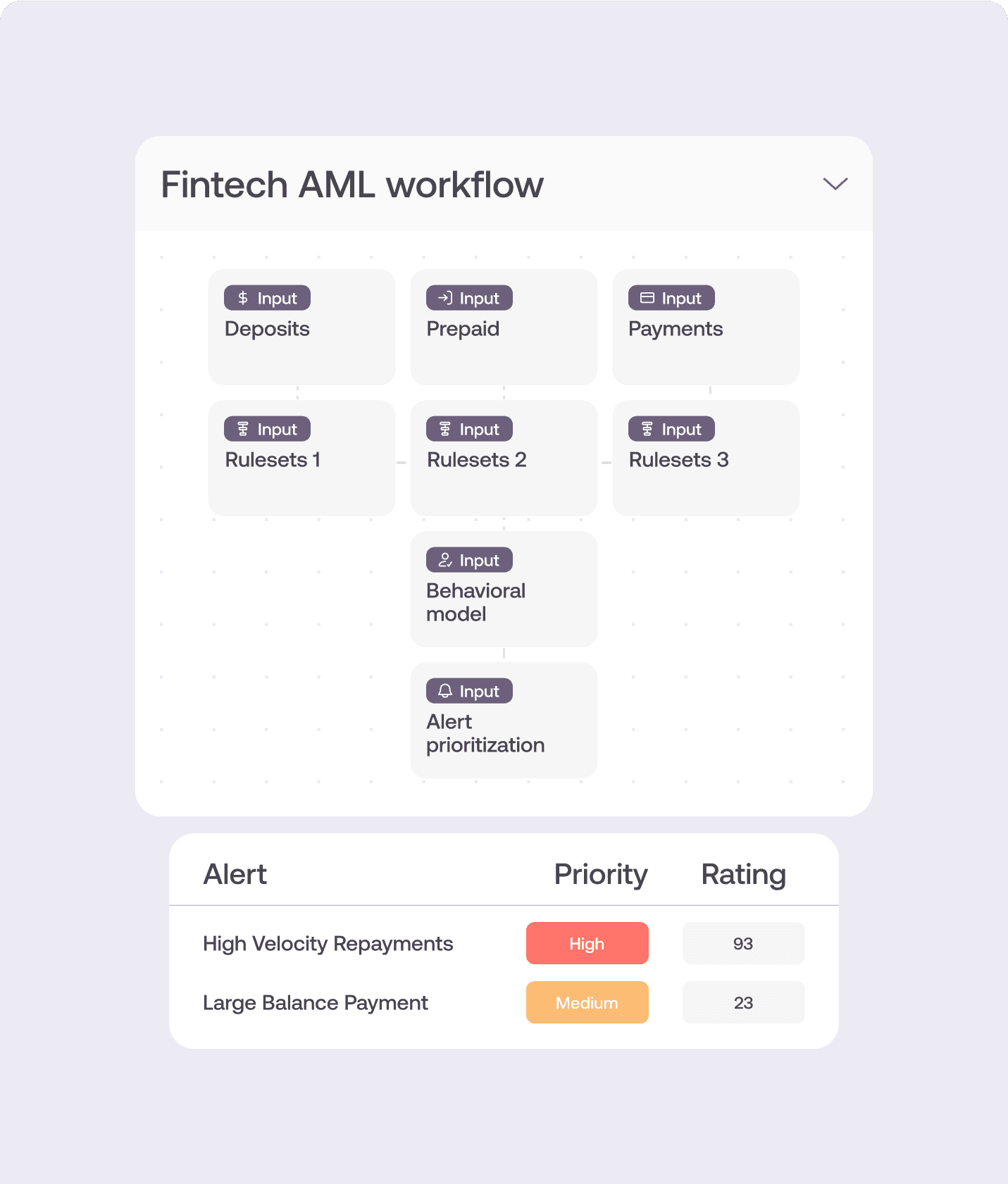

Leverage AI-driven models to prioritize critical FRAML alerts and uncover hidden patterns of illicit activity. Integrate real-time and batch processing effortlessly with full compliance support.

Out-of-the-Box AML Rules That Are Easy to Tune

Leverage customizable templates to adapt to industry-specific requirements across products, payment methods, compliance standards, and more.

Self-Service No-Code Rule Creation, Deploy in Minutes

Create and test FRAML rules without technical expertise, using a no-code, natural language interface that accelerates workflow adaptation to new compliance scenarios.

AI-Driven Case Management and Reporting

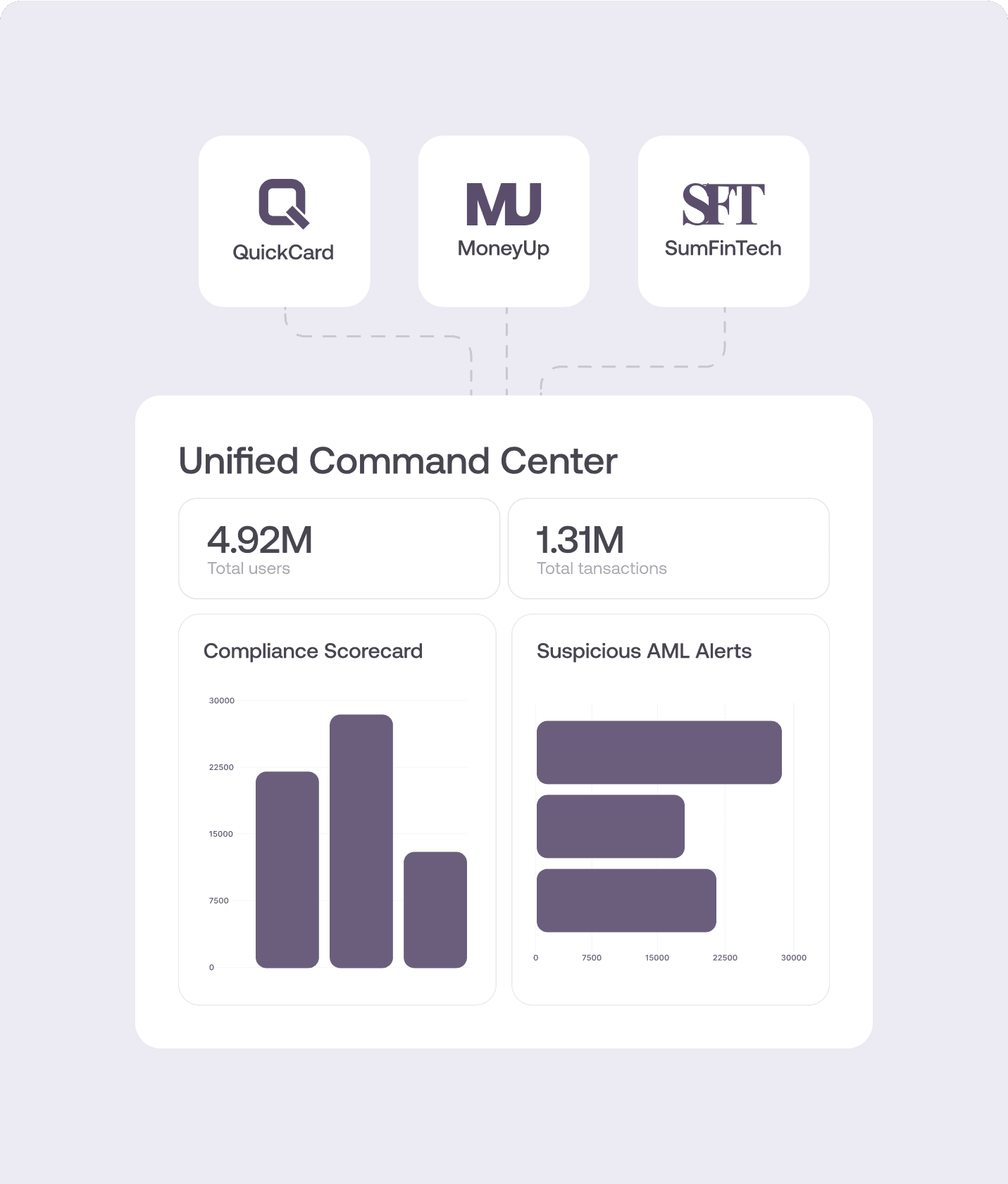

Centralize customer data from onboarding to payments across all products in a unified command center. Leverage AI-powered summaries to make faster decisions on alerts and cases, reducing review time by 50%.

Unified, End-to-End Risk Decisioning Platform

A comprehensive solution for all your risk decisioning needs—from AML compliance and customer onboarding to fraud and credit risk management.

See Oscilar in action.

Request a Demo →