AI-Powered Transaction Monitoring

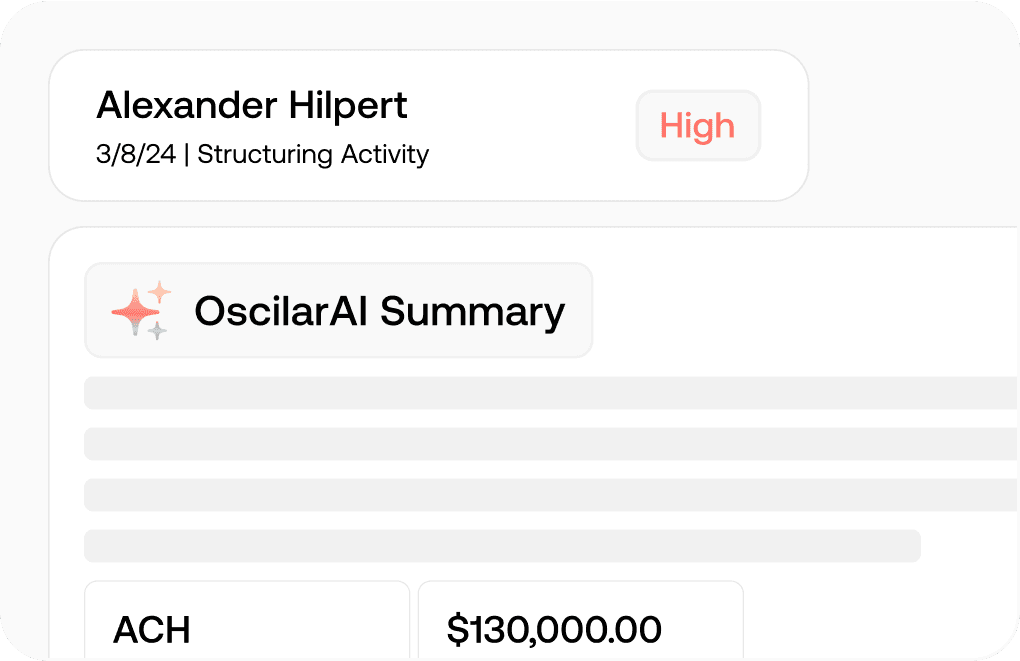

Monitor transactions in real-time to stop fraud and stay AML compliant. Oscilar’s AI-driven platform instantly detects suspicious activities, empowering you to fight fraud, stay compliant, and protect your business from financial crime.

Request a Demo

Why Top Banks, Fintechs, and Digital Organizations choose Oscilar?

Leverage State-of-the-Art ML Models to Defend Against Transaction Fraud Across

Various Payment Types and Schemes.

ACH Fraud

Detect unusual ACH transaction patterns, such as rapid debits and credits across multiple accounts, indicating potential fraud or kiting schemes.

Wire Fraud

Identify suspicious wire transfers, such as unexpected large transactions or transfers to high-risk jurisdictions, to prevent financial losses and money laundering.

Card Fraud

Spot signs of stolen card usage, card cloning, and card testing through advanced behavioral and transactional analysis.

Zelle Fraud

Detect scams using social engineering tactics to trick Zelle users into sending or receiving money as part of a fraud scheme.

Account Takeover (ATO)

Detect unusual account activities, login patterns, or transaction behaviors that may signal an account has been compromised.

Mule accounts

Monitor for signs of money muling, such as accounts receiving large or frequent deposits and then transferring those funds to unrelated external accounts.

See Oscilar in action.

Request a Demo →