Increase approval rates with Oscilar's risk decisioning platform

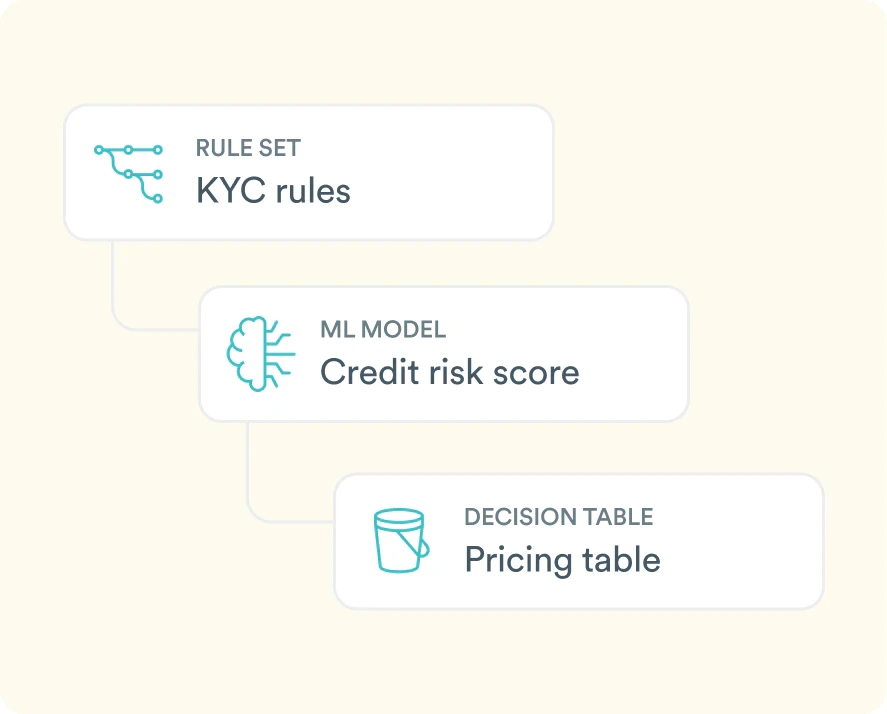

Express your most complex credit decisioning policies by combining Machine Learning with rules

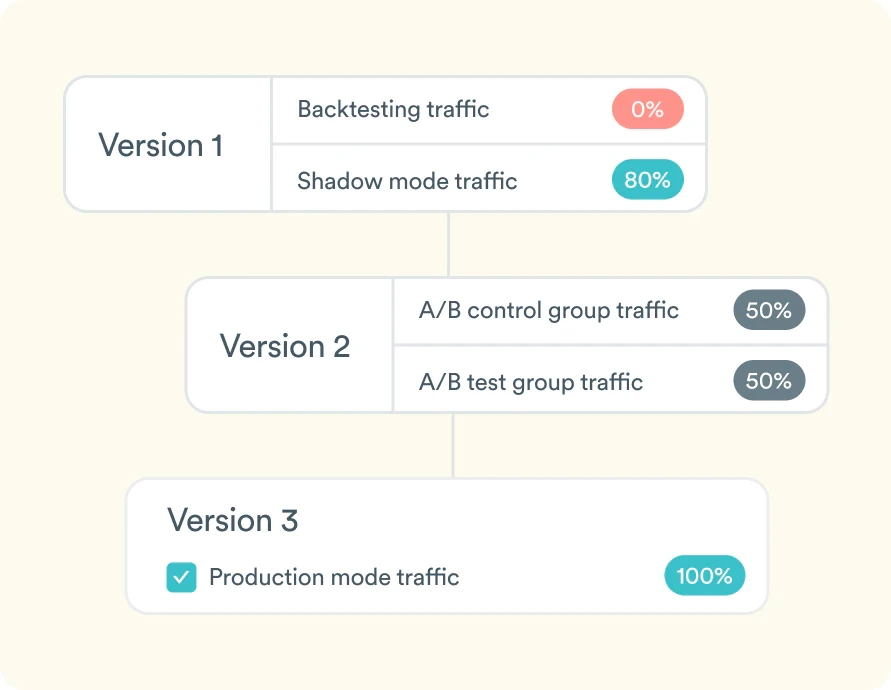

Test and experiment for optimal decisioning performance

The best credit decisioning starts at onboarding

Leverage Oscilar’s integrated fraud detection and credit decisioning capability with 100+ data sources to verify your customer’s identity and prevent fraud. Create powerful credit decisioning workflows using the right data at the right time to increase the accuracy of credit decisions, increase the efficiency of risk operations, and elevate customer experience.

Leverage open banking data and your transaction signals to improve your decisioning quality and boost automation levels in SMB lending.

Dive deeper than credit scores and start testing your credit policies faster. Increase loan originations across the board with no added risk.

"You should get a demo, amazing workflow management tool to tweak risk decisioning on the fly is best I ever see in in this space".

Chuck Davies · CRS Group · San Francisco, CA