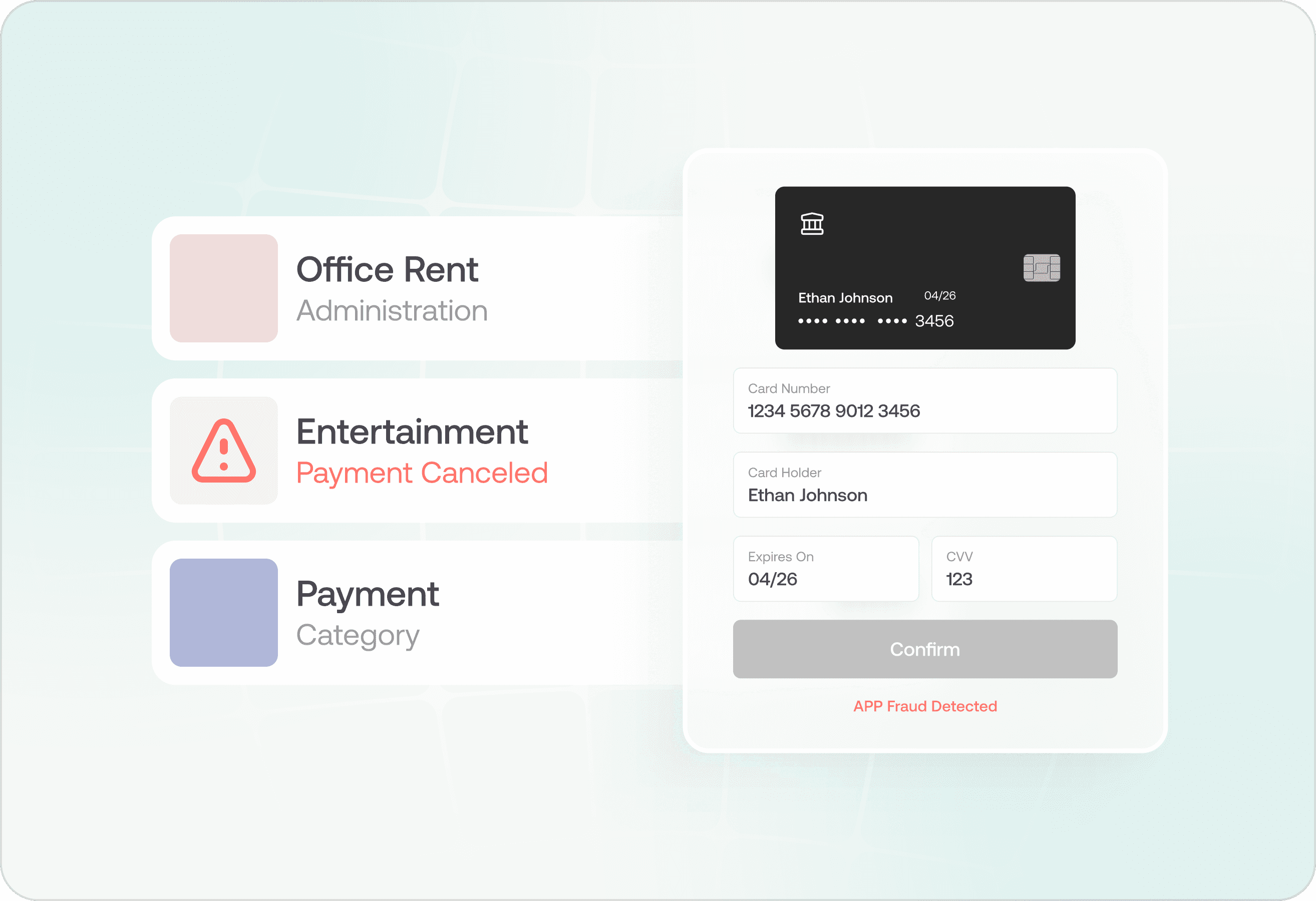

Authorized Push Payment (APP) fraud has become a critical concern for banks, fintechs, and other financial institutions. This sophisticated scam not only drains millions from victims' accounts but also undermines confidence in digital payment systems.

As fraudsters refine their tactics, traditional defense mechanisms struggle to keep pace.

This article will explore the intricacies of APP fraud, its far-reaching consequences, and how Oscilar's unified AI Risk Decisioning platform equips financial institutions to effectively combat this growing threat.

The Growing Importance of APP Fraud Prevention

Recent developments in the United Kingdom highlight the urgency of addressing APP fraud. Starting October 7, 2024, UK payment service providers must reimburse victims of APP fraud following new regulations by the government's payment regulator. This mandatory reimbursement requirement replaces a voluntary code and applies to all payment service providers using the Faster Payments system.

These new regulations underscore the severity of the APP fraud problem and its impact on both consumers and financial institutions. For banks and other payment providers, this means:

Increased financial liability for APP fraud cases

Greater pressure to implement robust fraud detection and prevention systems

The need for faster, more accurate decision-making in transaction processing

Potential reputational risks if unable to effectively combat APP fraud

While these regulations are specific to the UK, they signal a growing global awareness of APP fraud and may inspire similar measures in other countries. Financial institutions worldwide should take note and proactively strengthen their defenses against this evolving threat.

The Scale of the Problem

Recent studies have revealed the alarming prevalence and impact of APP fraud:

One in three consumers have fallen victim to an APP scam, highlighting how widespread this issue has become.

Only 25% of APP fraud cases are identified by the victim's bank, leaving a significant portion undetected and unreported.

APP scams are expected to reach a compound annual growth rate (CAGR) of 11% from 2022 to 2027, potentially reaching a total of USD $6.8 billion in losses globally.

These statistics underscore the urgent need for more effective solutions to combat APP fraud.

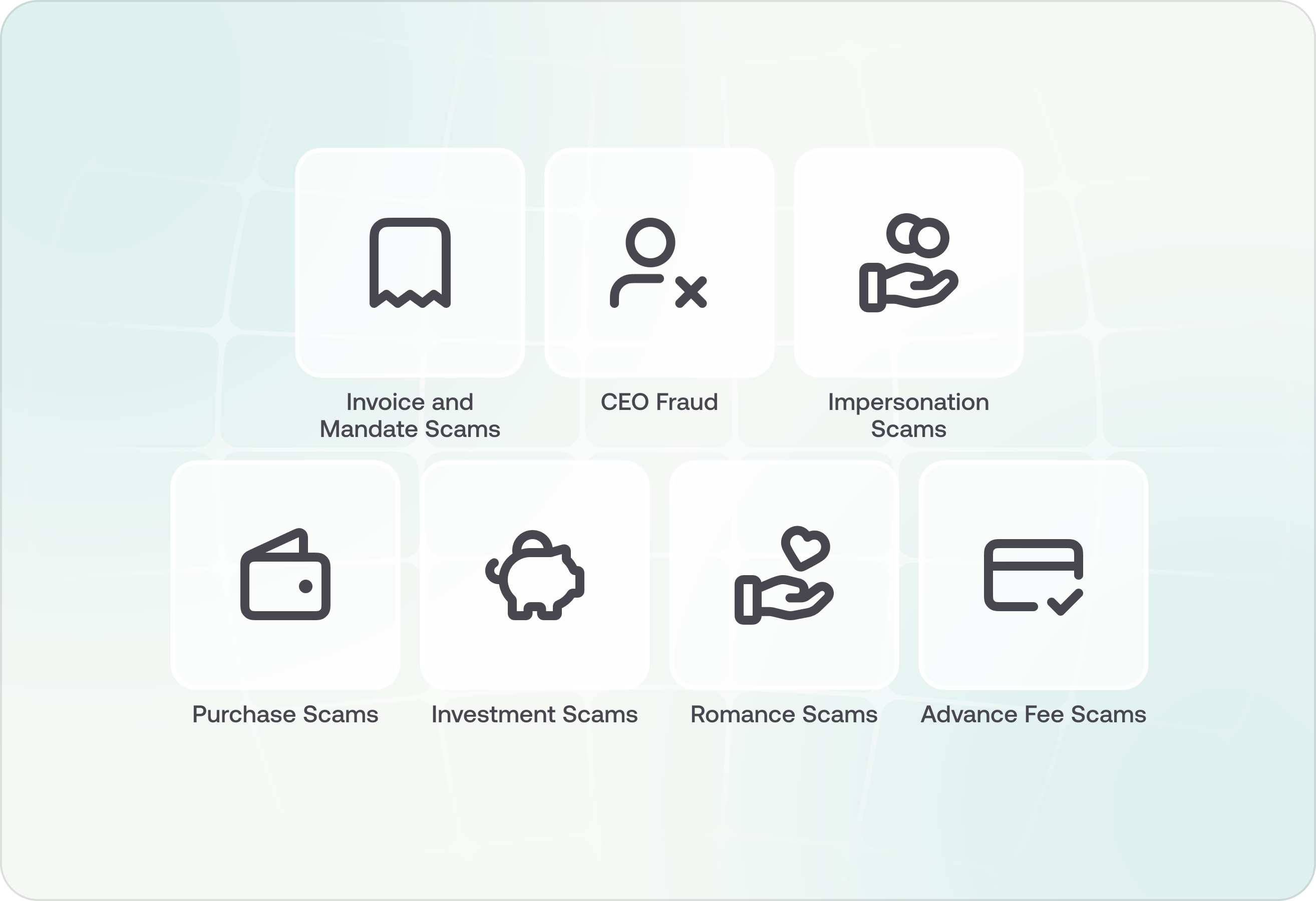

Types of APP Fraud

APP fraud can take many forms, each designed to exploit different vulnerabilities:

Invoice and Mandate Scams: Fraudsters intercept legitimate invoices and convince victims to redirect payments to their accounts.

CEO Fraud: Scammers impersonate high-ranking executives, tricking employees into making urgent payments.

Impersonation Scams: Criminals pose as trusted entities like banks, government agencies, or even family members to solicit payments.

Purchase Scams: Victims are convinced to pay for goods or services that never materialize.

Investment Scams: Fraudsters lure victims with promises of high returns on fake investments.

Romance Scams: Scammers build emotional relationships with victims before requesting money for supposed emergencies.

Advance Fee Scams: Victims are convinced to pay upfront fees for non-existent larger payouts.

Why APP Fraud is So Challenging

Several factors contribute to the complexity of combating APP fraud:

Authorized Transactions: Since the victim authorizes the payment, traditional fraud detection systems may not flag these transactions as suspicious. This makes it difficult to distinguish between legitimate payments and fraudulent ones.

Evolving Tactics: Fraudsters continually adapt their methods, leveraging social engineering and technology to make their scams more convincing. They're quick to exploit new channels and vulnerabilities, often staying one step ahead of traditional security measures.

Multiple Channels: APP scams can originate from various channels, including email, social media, phone calls, and text messages. This multi-channel approach makes it challenging for financial institutions to monitor all potential entry points effectively.

Psychological Manipulation: Scammers exploit emotional vulnerabilities, creating convincing narratives tailored to victims' circumstances. They often use urgency, fear, or excitement to cloud the victim's judgment and prompt quick action.

Rapid Transactions: With the rise of real-time payment systems, fraudsters can quickly move funds before the scam is detected. Once the money is transferred, it's often irrecoverable.

Lack of Consumer Awareness: Many consumers are overconfident in their ability to spot scams, creating a false sense of security. This complacency can make them more vulnerable to sophisticated APP fraud attempts.

Reputational Risk: Financial institutions face significant reputational damage if they're perceived as unable to protect their customers from APP fraud, even though the transactions are authorized by the victims themselves.

Why Traditional Prevention Methods Fall Short

Traditional fraud prevention methods often struggle with APP fraud for several reasons:

Rule-based Systems: Static rules can't keep up with the rapidly evolving tactics of fraudsters. By the time a new rule is implemented, scammers have often already moved on to new methods.

Siloed Data: Many institutions lack a unified view of customer behavior across channels and products. This fragmented approach makes it difficult to spot unusual patterns that might indicate APP fraud.

Delayed Detection: By the time traditional systems flag suspicious activity, the funds may already be gone. The irreversible nature of many modern payment systems means that even quick detection might be too late.

False Positives: Overly cautious systems can lead to legitimate transactions being blocked, frustrating customers and potentially driving them to competitors. This creates a delicate balance between security and user experience.

Limited Context: Traditional systems often lack the ability to understand the context of a transaction, which is crucial in distinguishing between legitimate payments and APP fraud.

Scalability Issues: As transaction volumes grow, manual review processes become unsustainable, leading to delays and potential oversights.

Oscilar's AI-Powered Solution

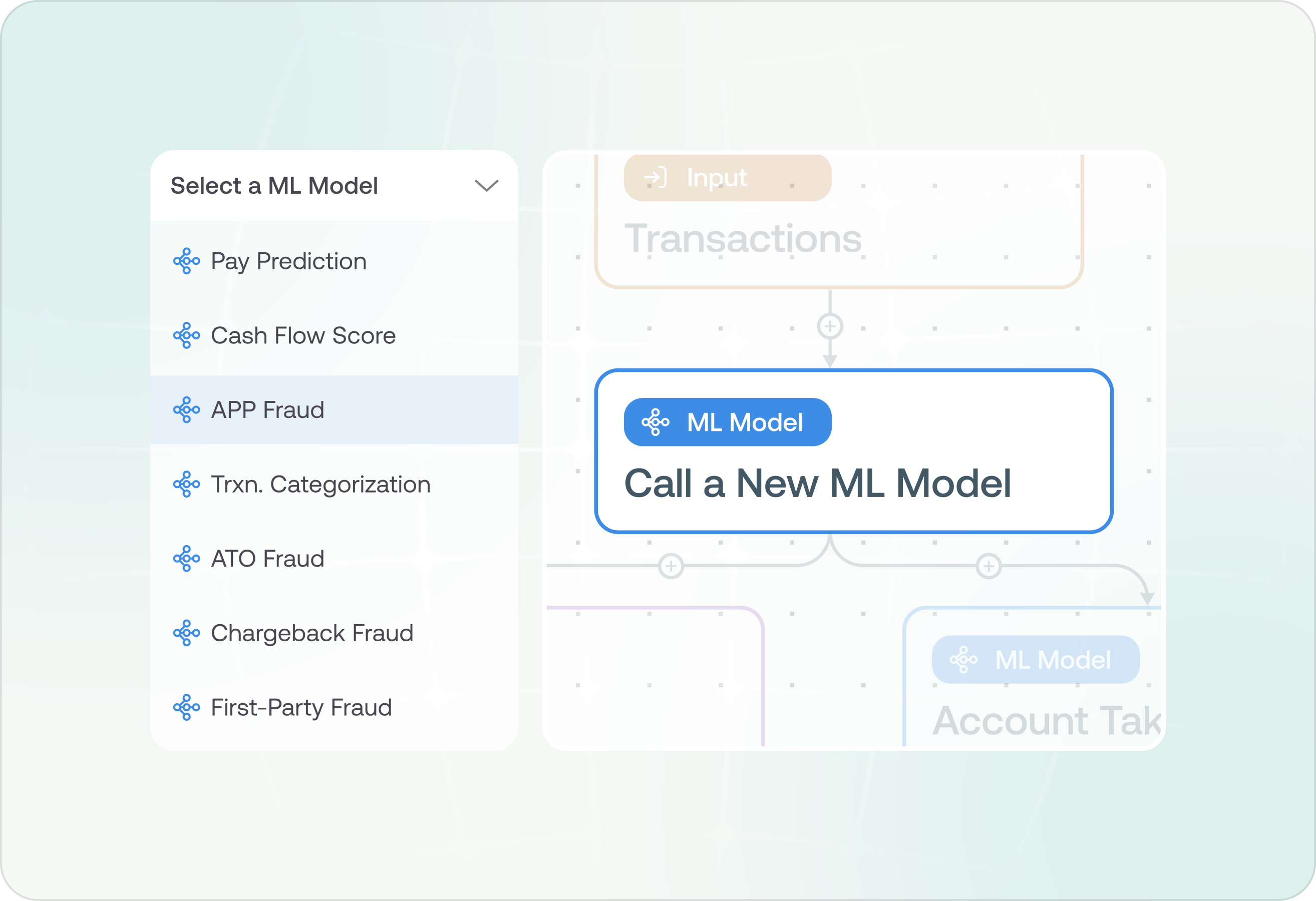

Oscilar's unified AI Risk Decisioning platform offers a comprehensive, cutting-edge approach to combating APP fraud:

Advanced Machine Learning: Our state-of-the-art ML models can detect nuanced fraud patterns in milliseconds, adapting to new threats in real-time. These models analyze vast amounts of data to identify suspicious patterns that might be invisible to human analysts or rule-based systems.

Example: Oscilar's ML models detect a sudden change in a customer's transaction pattern. A long-time customer who typically makes domestic transfers suddenly initiates a large international transfer to a new beneficiary. The ML model flags this as potentially suspicious, even though it doesn't violate any preset rules.360° Risk View: Leverage our comprehensive integration hub for a holistic view of customer behavior across all channels and products. This unified approach allows for more accurate risk assessment and fraud detection.

Example: A customer attempts to make a large transfer via mobile banking. Oscilar's platform instantly pulls data from multiple sources, including recent logins from unfamiliar devices, changes to account details, and unusual activity on linked accounts. This comprehensive view reveals that the customer recently changed their phone number and email, suggesting a possible account takeover preceding the APP fraud attempt.Real-time Decision Making: Make informed decisions instantly, crucial for stopping APP fraud in fast-paced payment environments. Our platform can analyze transactions and make decisions in milliseconds, potentially stopping fraudulent transfers before they're completed.

Example: During a high-value transfer, Oscilar's system detects multiple risk factors within milliseconds. It immediately triggers a step-up authentication, requiring the customer to confirm the transaction through a separate channel before it's processed, potentially stopping a fraudulent transfer in real-time.Reduced False Positives: Our AI fine-tunes decision-making, reducing false positives while maintaining robust security. This helps maintain a positive customer experience without compromising on fraud prevention.

Example: A customer makes a large transfer to a new payee. Instead of automatically blocking the transaction, Oscilar's AI analyzes the customer's history, recent interactions, and the context of the transfer. It determines that while unusual, this transfer is consistent with the customer's recent life events (e.g., purchasing a home), and allows the transaction to proceed without unnecessary interruption.AI Explainability: Get immediate answers to complex questions like "What caused a 12% increase in fraud chargebacks?" using natural language queries. This feature helps risk teams quickly understand and respond to emerging fraud trends.

Example: A risk analyst asks, "Why did we see a spike in investment scams last month?" Oscilar's AI responds with a detailed analysis: "The 27% increase in investment scams correlates with the launch of a new cryptocurrency and increased social media advertising targeting users aged 25-40. 80% of the victims were first-time investors, and 60% of the fraudulent transactions originated from IP addresses in region X."Workflow Assistance Co-Pilot: Easily create and optimize fraud prevention workflows using natural language commands. This intuitive interface allows risk teams to implement and adjust strategies quickly without relying heavily on IT resources.

Example: A risk manager says, "Create a workflow to flag transfers over $10,000 to new beneficiaries for customers over 65." The Co-Pilot generates a workflow that includes additional checks like verifying recent account changes, analyzing the customer's transaction history, and triggering a confirmation call for high-risk transfers.AI Case Management: Speed up case reviews with proactive insights and natural language explanations of flagged cases. This helps investigators work more efficiently and effectively, potentially uncovering complex fraud schemes.

Example: An investigator reviews a flagged case. Oscilar's AI provides a summary: "High-risk transfer of $25,000 to a new beneficiary. Customer claims it's for a property purchase, but beneficiary account has received similar transfers from 5 other customers in the past week. Recommend immediate callback and potential transaction reversal."Behavioral Biometrics: Analyze user behavior patterns to identify anomalies that might indicate fraudulent activity, even when the transaction itself appears legitimate.

Example: During an online banking session, Oscilar detects unusual typing patterns, mouse movements, and navigation behavior inconsistent with the account holder's typical usage. This triggers additional verification steps, potentially catching an impersonator before they can initiate a fraudulent transfer.Network Analysis: Identify connections between seemingly unrelated accounts or transactions to uncover organized APP fraud rings.

Example: Oscilar identifies a pattern where multiple seemingly unrelated accounts are making transfers to a common set of beneficiaries. Further analysis reveals these accounts were all recently accessed from the same IP range, suggesting a coordinated APP fraud operation.Continuous Learning: Our AI models continuously learn from new data, ensuring they stay up-to-date with the latest fraud tactics without manual intervention.

Example: After a new type of investment scam is identified, Oscilar's AI quickly adapts its models. Within days, it starts flagging similar patterns in other transactions, preventing the scam from spreading widely and protecting customers who might have otherwise fallen victim to this new fraud tactic.

Get Started with Oscilar

In an era where APP fraud is on the rise, it's crucial for financial institutions to adopt advanced, AI-driven solutions. Oscilar's unified AI Risk Decisioning platform offers the comprehensive, adaptable, and intelligent approach needed to tackle this complex challenge head-on.

By leveraging cutting-edge AI technology, financial institutions can not only protect themselves and their customers from financial losses but also build trust in digital financial services. This trust is crucial for the continued growth and innovation in the fintech sector.

Ready to revolutionize your fraud decision-making with cutting-edge AI?

Join the RiskCon Community to be part of the largest group of experts in risk, credit underwriting, and fraud prevention.

Sign up for the best newsletter in the Risk & Fraud management space below

Or by booking a demo directly to see Oscilar in action