The Rise of ACH and the Looming Threat of Fraud

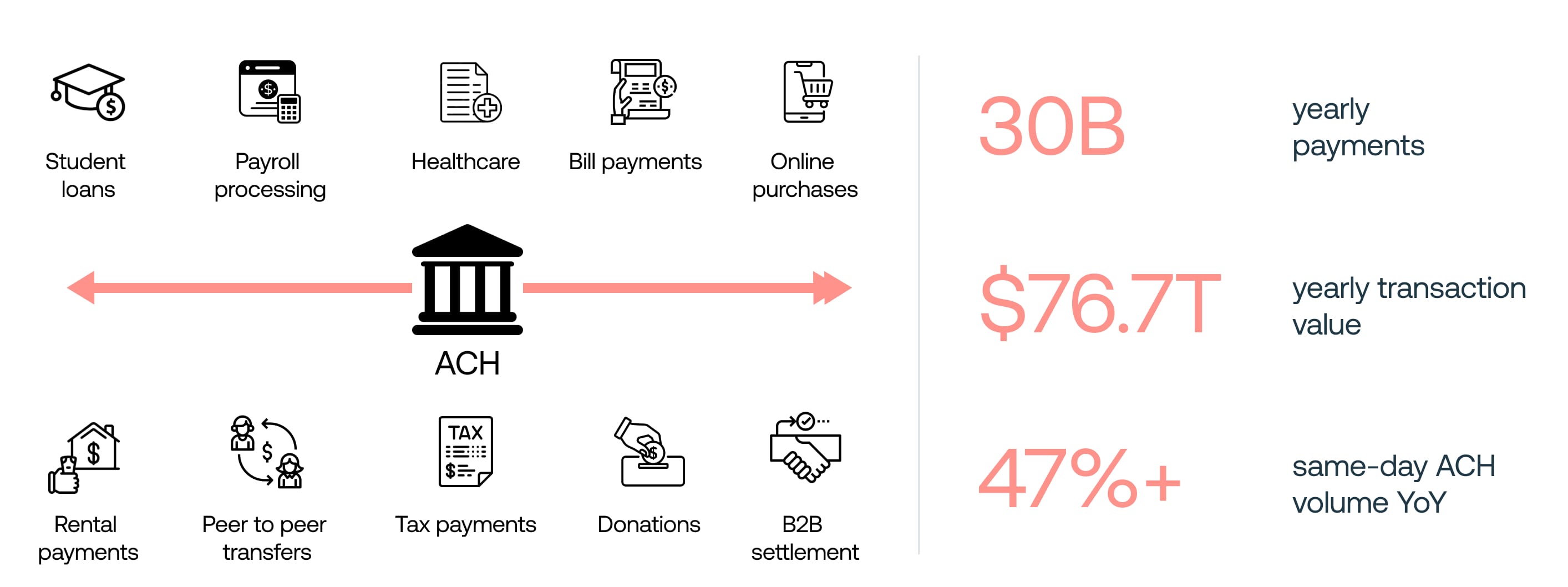

The Automated Clearing House (ACH) network has become the cornerstone of the modern financial ecosystem, enabling a wide array of essential transactions, including payroll processing, bill payments, online purchases, peer-to-peer transfers, and business-to-business settlements.

As the digital economy continues to expand, the ACH network has experienced unprecedented growth, processing a staggering 8.2 billion payments in the first quarter of 2024 alone. This growth is further accelerated by the 47% increase in Same-Day ACH volume, allowing for faster transaction settlement. However, this rapid growth and the increased speed of transactions pose significant challenges to fraud detection and prevention efforts, as fraudsters continually adapt their tactics to exploit vulnerabilities in the system.

Digitization Trends and the Rise of Embedded Finance: A Double-Edged Sword

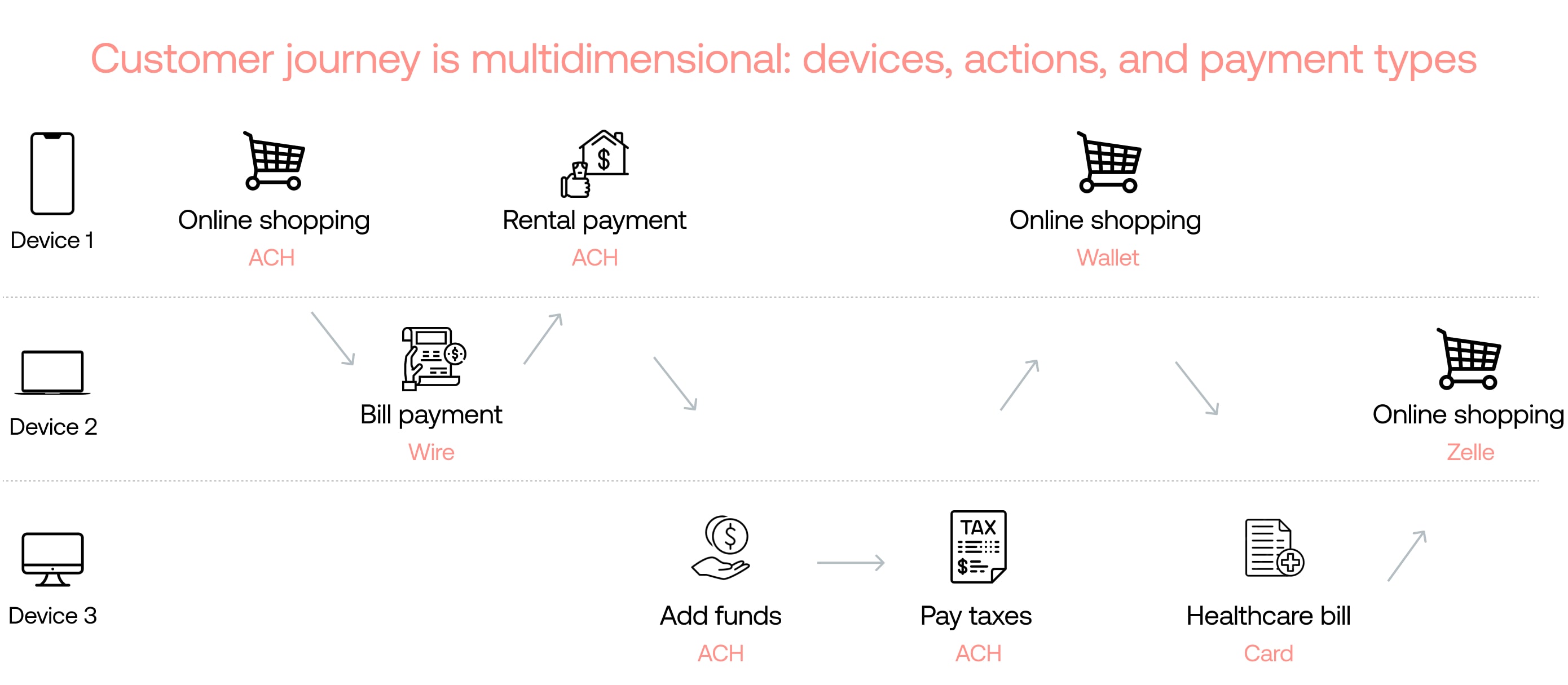

The rapid growth of the ACH network can be attributed to the widespread adoption of digital experiences and the rise of integrated payment solutions. Traditional financial institutions and fintech companies have revolutionized the financial landscape by offering innovative, user-friendly, and accessible financial services. These advancements have made transactions easier for consumers and businesses, contributing to the ACH network's exponential growth.

Embedded finance, in particular, has gained traction by seamlessly integrating financial services into non-financial platforms. This enhances customer experiences and fosters financial inclusion. For example, ride-sharing apps offering in-app payment solutions, e-commerce platforms providing instant credit options, or social media platforms enabling peer-to-peer payments are prime examples of how embedded finance is transforming financial interactions. The convenience and accessibility of these services drive more users to adopt digital payment methods, further boosting the volume of ACH transactions.

However, this remarkable growth has not gone unnoticed by fraudsters. As the volume and velocity of ACH transactions increase, so does the complexity and sophistication of fraudulent schemes. The increased adoption of digital payment methods directly correlates to the increased risk of ACH fraud, as cybercriminals continuously develop new techniques to exploit vulnerabilities within the ACH system, posing significant risks to financial institutions, businesses, and consumers alike. The need for advanced fraud detection and prevention mechanisms has never been more critical.

In this article, we will explore the various types of ACH fraud, the reasons why current solutions often fall short, and how Oscilar's ACH Fraud Detection Product offers a robust solution to these pressing challenges.

The Current State of ACH Fraud: An Evolving Threat Landscape

The exponential growth of the ACH network, while beneficial for the digital economy, has also led to a surge in fraud. Several key dynamics are contributing to this increase: The attacker ecosystem has evolved dramatically with the advent of automation tools and GenAI-enabled technologies. These advancements have made sophisticated attack methods more accessible and scalable, allowing cybercriminals to target vulnerabilities across multiple platforms efficiently. Organized crime networks leverage social platforms like Telegram and Discord to share strategies and tools, further enhancing their reach and impact.

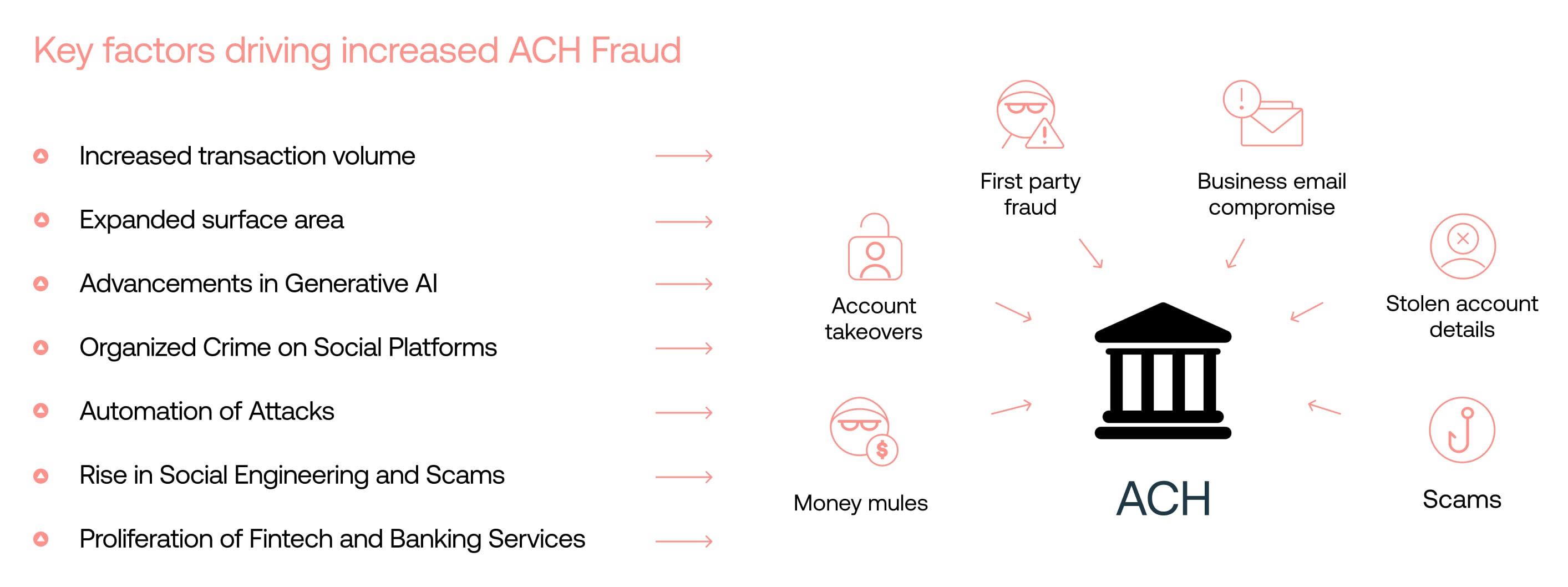

Key Factors Driving Increased ACH Fraud: A Closer Look

Increased Transaction Volumes: The surge in ACH transaction volumes provides fraudsters with more opportunities to exploit the system. As the number of transactions grows, it becomes increasingly challenging to monitor and detect fraudulent activities effectively.

Expanded Surface Area: The integration of payments into a wide range of digital experiences has created more touchpoints where vulnerabilities can be exploited. Each new integration presents potential gaps that fraudsters can target, making it harder to secure the entire payment ecosystem.

Advancements in Generative AI: The advent of generative AI has made fraud tactics more sophisticated and harder to detect. Fraudsters can now create deepfake videos, audio, and convincingly responsive content to deceive victims and evade detection systems that rely on traditional fraud indicators.

Organized Crime on Social Platforms: Social platforms like Telegram and Discord have become hotbeds for organized crime, enabling fraudsters to share strategies, tools, and stolen data. This collaboration enhances their ability to execute large-scale fraud operations and adapt quickly to new fraud prevention measures.

Automation of Attacks: Fraudsters employ automation tools such as bots, scripts, and obfuscation technologies to carry out fraud at scale. These tools can automate breaches, perform rapid attacks, and evade detection with increasing efficiency, making it challenging for traditional fraud prevention systems to keep pace.

Rise in Social Engineering and Scams: Social engineering tactics exploit human psychology to deceive individuals into divulging sensitive information or authorizing fraudulent transactions. As these tactics become more sophisticated, they become harder to detect and prevent using conventional fraud detection methods.

Proliferation of Fintech and Banking Services: The emergence of new fintech platforms that allow users to open multiple accounts seamlessly, sometimes without stringent verification processes, can be exploited for fraudulent purposes. Fraudsters can validate themselves across multiple services and abuse the system for personal gain, making it difficult to track and prevent their activities.

ACH Fraud Types in the Digital-First and GenAI-Enabled World: A Complex Landscape

ACH fraud types have become increasingly complicated in this digital-first and GenAI-enabled world. The sophistication and variety of fraudulent schemes present significant challenges for traditional detection methods. Here are some of the most prevalent types of ACH fraud today:

First-Party Fraud: This type of fraud occurs when customers intentionally initiate ACH transactions with insufficient funds or falsely claim they didn't authorize payments, exploiting the ACH system for personal gain. Detecting first-party fraud is challenging as it involves legitimate account holders, making it difficult to distinguish between genuine and fraudulent transactions.

Account Takeover: Fraudsters use compromised device IDs and behavioral patterns to access banking app accounts and initiate unauthorized transactions. This type of fraud poses significant financial risks for account holders and is difficult to prevent due to the use of legitimate credentials, which can bypass traditional security measures.

Stolen Account Details: Fraudsters use stolen credentials to perform unauthorized ACH transactions outside the banking app, posing a severe threat to financial institutions. These transactions often appear legitimate, as they originate from valid accounts, making them challenging to detect using standard security checks.

Scams: Fraudulent schemes manipulate transaction patterns, notes, and recipient information to deceive customers and initiate unauthorized ACH transactions. The dynamic nature of these scams makes them difficult to detect with static rule-based systems, as they constantly evolve to evade detection.

Business Email Compromise (BEC): In BEC scams, fraudsters impersonate vendors or executives to trick companies into making ACH payments to fraudulent accounts. The convincing nature of these deceptions often results in substantial financial losses, as employees may not recognize the fraudulent nature of the request.

Money Mules: Money mules are accounts used to receive and transfer fraudulent funds, often as part of larger criminal networks. Detecting money mule activities is challenging, as these transactions may appear legitimate unless analyzed in a broader context and across multiple institutions.

ACH Check Kiting: In check kiting schemes, criminals exploit the clearing house process by moving money between accounts at different banks, creating the illusion of available funds. Detecting check kiting requires analyzing the timing and sequence of transactions across multiple institutions, making it difficult for individual banks to identify.

Current Fraud Tools Fall Short: The Limitations of Traditional ACH Fraud Detection

While many fraud detection vendors offer solutions for ACH fraud, these traditional approaches often fall short in effectively combating the evolving and sophisticated nature of fraudulent activities. Here are some key reasons why current fraud vendors may not be the best choice for ACH fraud detection:

Overreliance on Rule-Based Systems: Many fraud vendors heavily rely on static rule-based systems that fail to adapt to new and emerging fraud patterns. These rules are often based on historical data and known fraud scenarios, making them less effective in detecting novel fraud techniques. Fraudsters continuously innovate and find ways to circumvent these static rules, rendering them obsolete over time.

Lack of Real-Time Data Analysis: ACH fraud detection requires real-time analysis of vast amounts of data across multiple channels and systems. However, many fraud vendors struggle to process and analyze data in real-time, leading to delayed fraud detection and response. This limitation allows fraudsters to exploit the time gap between the execution of a fraudulent transaction and its detection, making it harder to prevent financial losses.

Siloed Data and Limited Integration: Effective ACH fraud detection requires a holistic view of customer activity across various channels and systems. Unfortunately, many fraud vendors operate with siloed data and limited integration capabilities. This fragmented approach hinders the ability to identify suspicious patterns and anomalies that span multiple channels, making it easier for fraudsters to evade detection.

Insufficient Behavioral Analysis: Detecting sophisticated ACH fraud schemes often requires analyzing user behavior and identifying anomalies in transaction patterns. However, traditional fraud vendors may not have the advanced behavioral analysis capabilities needed to detect subtle deviations from normal user behavior. This limitation allows fraudsters to impersonate legitimate users and carry out fraudulent activities without triggering alerts.

Lack of Explainable AI: As fraud detection solutions increasingly leverage artificial intelligence and machine learning, the transparency and explainability of these models become crucial. Many current fraud vendors use 'black box' AI models that lack clear explanations for why a particular transaction is flagged as fraudulent. This lack of transparency can lead to false positives, customer frustration, and difficulty in meeting regulatory requirements.

Limited Customization and Scalability: ACH fraud detection requirements can vary significantly across different financial institutions and fintech companies. Current fraud vendors often offer one-size-fits-all solutions that lack the flexibility to adapt to specific business needs and risk profiles. Additionally, these solutions may struggle to scale effectively as transaction volumes and complexity increase, leading to performance bottlenecks and increased false positives.

Slow Adoption of Emerging Technologies: The rapidly evolving nature of ACH fraud requires frequent updates and enhancements to fraud detection systems. However, many traditional fraud vendors may be slow to adopt emerging technologies such as generative AI, cross-institutional data sharing, and real-time transaction scoring. This lag in innovation leaves financial institutions vulnerable to new and sophisticated fraud tactics.

High Operational Costs and False Positive Rates: Outdated fraud detection tools often lead to increased operational costs due to the need for manual reviews and investigations. Moreover, these tools often generate high false positive rates, where legitimate transactions are incorrectly flagged as fraudulent. This not only frustrates customers but also leads to potential loss of business, as customers may take their business elsewhere due to the inconvenience caused by false positives.

To effectively combat ACH fraud, financial institutions and fintech companies need to look beyond traditional fraud vendors and adopt advanced solutions that leverage real-time data analysis, behavioral profiling, explainable AI, and cross-institutional collaboration. These solutions should be flexible, scalable, and able to adapt quickly to the ever-changing fraud landscape, providing a more comprehensive and effective approach to ACH fraud detection and prevention.

Oscilar: The Future of ACH Fraud Detection and Prevention

As the Chief Product Officer of Oscilar, I am proud to share how our AI Risk Decisioning Platform addresses the pressing challenges of ACH fraud with advanced, real-time solutions. Oscilar leverages cutting-edge technology and innovative approaches to provide a comprehensive defense against the evolving landscape of financial crime.

Real-time ACH Workflow Orchestration: Stopping Fraud in Its Tracks

Data Analysis: Oscilar collects and analyzes multiple data points in real-time, including open banking data, creating a rich and comprehensive dataset. By leveraging advanced data analysis techniques, we can quickly and accurately detect anomalies and suspicious patterns indicative of first-party fraud, second-party fraud, or third-party fraud.

Behavioral Profiling: Our platform employs highly dimensional feature engineering to develop detailed behavioral profiles across every data attribute. This allows us to identify unusual activities that may signal fraud, even when they mimic legitimate user behavior. By continuously learning and adapting to new patterns, Oscilar stays ahead of the curve in detecting sophisticated fraud schemes.

Digital Identity: Oscilar monitors device IDs and behavioral biometrics and patterns to detect account takeovers and fraudulent ACH transactions initiated from compromised banking app accounts. By analyzing user behavior and device characteristics in real-time, we can protect customers' funds from unauthorized access and prevent fraudulent transactions before they occur.

Integration with MFA and Other Systems: Oscilar seamlessly integrates with Multi-Factor Authentication (MFA) and other security systems. By testing performance and orchestrating real-time decisions, we ensure that every transaction is evaluated accurately and efficiently. This integration enables us to provide a comprehensive and unified fraud prevention solution that adapts to the unique needs of each financial institution.

Leveraging Applied ML for Enhanced Fraud Detection & Investigation: Outsmarting the Fraudsters

Hybrid AI Approach: Oscilar uses a hybrid AI approach that combines supervised, unsupervised, and generative AI techniques, along with data intelligence and intelligent rules. This multifaceted approach enhances our ability to detect and respond to ACH fraud originating from scams, Business Email Compromise, or ACH kiting. By leveraging the strengths of each AI technique, we can identify complex fraud patterns and adapt to new fraud tactics in real-time.

Intelligent Alert Prioritization: By leveraging machine learning and big data analytics, Oscilar identifies unique ACH risks and prioritizes essential alerts. This minimizes false positives and ensures that critical threats are addressed promptly. Our intelligent alert prioritization system continuously learns from feedback and adapts to new fraud patterns, ensuring that our fraud detection remains effective and efficient.

Advanced Network Analysis: Our platform utilizes graph analysis for entity link analysis, point of compromise identification, and complex user and money flow analysis. This helps in understanding and disrupting sophisticated fraud networks, mule behaviors, or synthetic IDs and stolen data used for committing ACH fraud. By uncovering hidden connections and identifying key players in fraud networks, Oscilar enables financial institutions to take proactive measures to prevent fraud losses.

Explainable and Fair AI: Oscilar ensures AI explainability, fairness, and governance through rigorous controls and human oversight. This transparency builds trust and allows for effective regulatory compliance. By providing clear explanations for why a transaction is flagged as fraudulent, we empower fraud analysts to make informed decisions and reduce false positives. Our commitment to fair and unbiased AI ensures that our fraud detection system treats all customers equally and protects against discriminatory practices.

RiskOps Visibility and Control: Empowering Fraud Teams with Actionable Insights

Unified Platform for ACH Fraud Ops Monitoring and Reporting: Oscilar provides a unified platform for monitoring and reporting ACH fraud operations. This centralization enhances visibility and control over fraud detection and prevention efforts. By consolidating data and insights from multiple sources, our platform enables fraud teams to identify trends, patterns, and emerging threats quickly and efficiently.

Real-time Alerts: Our platform generates real-time alerts, enabling proactive and automated risk operations decisions. This ensures swift responses to potential threats, minimizing the impact of fraudulent activities. By providing timely and accurate alerts, Oscilar empowers fraud teams to take immediate action and prevent fraud losses.

Omnichannel Cases: Oscilar's dynamic case cards summarize and visualize any data, facilitating deep investigations and quick relationship analysis. This feature helps fraud analysts to make informed decisions rapidly. By presenting relevant information in a clear and concise format, our platform streamlines the investigation process and enables fraud teams to resolve cases more efficiently.

Entity View: We bring together insights and analytics across customer touchpoints to create a single view of the customer. This holistic perspective is crucial for effective fraud detection and customer relationship management. By understanding the full context of a customer's interactions, fraud teams can identify suspicious patterns and take appropriate actions to prevent fraud and protect genuine customers.

Smart Actions: Oscilar supports collaboration across different teams through smart actions, including escalations, queue management, smart lists, auto links, and re-triggered decisions. This enhances operational efficiency and effectiveness. By automating routine tasks and providing intelligent recommendations, our platform enables fraud teams to focus on high-priority cases and make faster, more informed decisions.

Oscilar AI, a Gen AI-First Risk Co-Pilot: Augmenting Human Expertise with AI Insights

AI Monitoring: Our AI continuously monitors performance, new attack vectors, and anomalies, ensuring that our fraud detection strategies remain up-to-date and effective. By analyzing vast amounts of data in real-time, Oscilar's AI identifies emerging fraud patterns and proactively adapts our detection models to stay ahead of fraudsters.

Assisted Rules and Fraud Strategy Creations: Oscilar assists in creating and refining fraud detection rules and strategies, leveraging AI insights to enhance their effectiveness. By analyzing historical data and real-time fraud patterns, our AI provides recommendations for optimizing rules and thresholds, enabling fraud teams to create more targeted and effective fraud prevention strategies.

AI Case Narrative & Summaries: Our platform generates AI-driven case narratives and summaries, providing clear and concise insights for fraud analysts. These narratives highlight key facts, suspicious patterns, and recommended actions, enabling analysts to quickly understand the context of each case and make informed decisions. By automating the creation of case narratives, Oscilar reduces manual effort and improves the efficiency of fraud investigations.

AI Insights: Oscilar offers deep AI insights, helping organizations understand and anticipate fraud trends and patterns. By analyzing large volumes of data across multiple institutions and channels, our AI identifies emerging fraud tactics and provides actionable insights for proactive fraud prevention. These insights enable financial institutions to stay ahead of fraudsters and adapt their fraud prevention strategies in real-time.

Oscilar - Your Trusted Partner in the Fight Against ACH Fraud

Oscilar's ACH Fraud Detection Product is designed to tackle the most sophisticated and evolving fraud challenges. By leveraging real-time data analysis, advanced machine learning, and comprehensive risk operations management, we provide robust and adaptive solutions to protect financial institutions, businesses, and consumers. Our commitment to innovation, transparency, and operational excellence ensures that we stay ahead of fraudsters and safeguard the integrity of the ACH network.

See our AI-powered ACH Fraud Detection solution solution page

Read the AI-powered ACH Fraud Detection solution press release

Or book a demo directly to see Oscilar in action