cognitive identity intelligence

Stop sophisticated fraud before it starts.

Protect your customers with military-grade device intelligence and behavioral analysis that catches what others miss.

cognitive identity intelligence

Stop sophisticated fraud before it starts.

Protect your customers with military-grade device intelligence and behavioral analysis that catches what others miss.

cognitive identity intelligence

Stop sophisticated fraud before it starts.

Protect your customers with military-grade device intelligence and behavioral analysis that catches what others miss.

cognitive identity intelligence

Stop sophisticated fraud before it starts.

Protect your customers with military-grade device intelligence and behavioral analysis that catches what others miss.

Trusted by institutions building next-gen finance

Trusted by institutions building next-gen finance

Trusted by institutions building next-gen finance

Trusted by institutions building next-gen finance

Yesterday’s security wasn’t built for today’s sophisticated threats. Identity spoofing, behavior mimicking, and malicious Generative AI techniques are on the rise. So we built Cognitive Identity Intelligence to keep you ahead of the curve.

Empower your risk teams to operate autonomously, increase approval rates, reduce fraud rates, and stay compliant. Leverage one-click integrations, an intuitive natural language interface, and Oscilar AI.

Empower your risk teams to operate autonomously, increase approval rates, reduce fraud rates, and stay compliant. Leverage one-click integrations, an intuitive natural language interface, and Oscilar AI.

Empower your risk teams to operate autonomously, increase approval rates, reduce fraud rates, and stay compliant. Leverage one-click integrations, an intuitive natural language interface, and Oscilar AI.

Benefits

A new security-first approach to stop fraud.

Oscilar's first-of-its-kind cognitive identity intelligence is built to stay one step ahead of bad actors in the age of AI.

Benefits

A new security-first approach to stop fraud.

Oscilar's first-of-its-kind cognitive identity intelligence is built to stay one step ahead of bad actors in the age of AI.

Benefits

A new security-first approach to stop fraud.

Oscilar's first-of-its-kind cognitive identity intelligence is built to stay one step ahead of bad actors in the age of AI.

Benefits

A new security-first approach to stop fraud.

Oscilar's first-of-its-kind cognitive identity intelligence is built to stay one step ahead of bad actors in the age of AI.

Real-Time Intelligence

Process thousands of signals in milliseconds to stop fraud without adding friction.

Real-Time Intelligence

Process thousands of signals in milliseconds to stop fraud without adding friction.

Real-Time Intelligence

Process thousands of signals in milliseconds to stop fraud without adding friction.

Real-Time Intelligence

Process thousands of signals in milliseconds to stop fraud without adding friction.

Security-First Architecture

Built with military-grade encryption and dynamic security patterns that make reverse engineering impossible.

Security-First Architecture

Built with military-grade encryption and dynamic security patterns that make reverse engineering impossible.

Security-First Architecture

Built with military-grade encryption and dynamic security patterns that make reverse engineering impossible.

Security-First Architecture

Built with military-grade encryption and dynamic security patterns that make reverse engineering impossible.

Contextual Cognitive Signatures

Thousands of digital markers across device, network, behavioral dimensions that protect against sophisticated AI-powered attacks.

Contextual Cognitive Signatures

Thousands of digital markers across device, network, behavioral dimensions that protect against sophisticated AI-powered attacks.

Contextual Cognitive Signatures

Thousands of digital markers across device, network, behavioral dimensions that protect against sophisticated AI-powered attacks.

Contextual Cognitive Signatures

Thousands of digital markers across device, network, behavioral dimensions that protect against sophisticated AI-powered attacks.

end-to-end defense

Stop fraudsters at every touchpoint of the user journey.

Invisible protection from sign-up to checkout that follows your users' journey, catching fraud and scams while keeping checkout frictionless.

end-to-end defense

Stop fraudsters at every touchpoint of the user journey.

Invisible protection from sign-up to checkout that follows your users' journey, catching fraud and scams while keeping checkout frictionless.

end-to-end defense

Stop fraudsters at every touchpoint of the user journey.

Invisible protection from sign-up to checkout that follows your users' journey, catching fraud and scams while keeping checkout frictionless.

end-to-end defense

Stop fraudsters at every touchpoint of the user journey.

Invisible protection from sign-up to checkout that follows your users' journey, catching fraud and scams while keeping checkout frictionless.

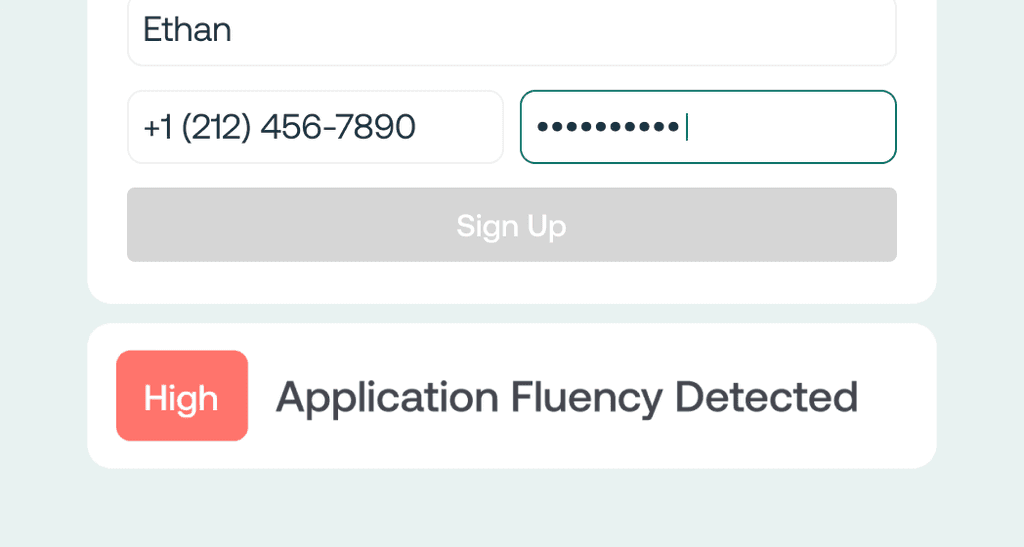

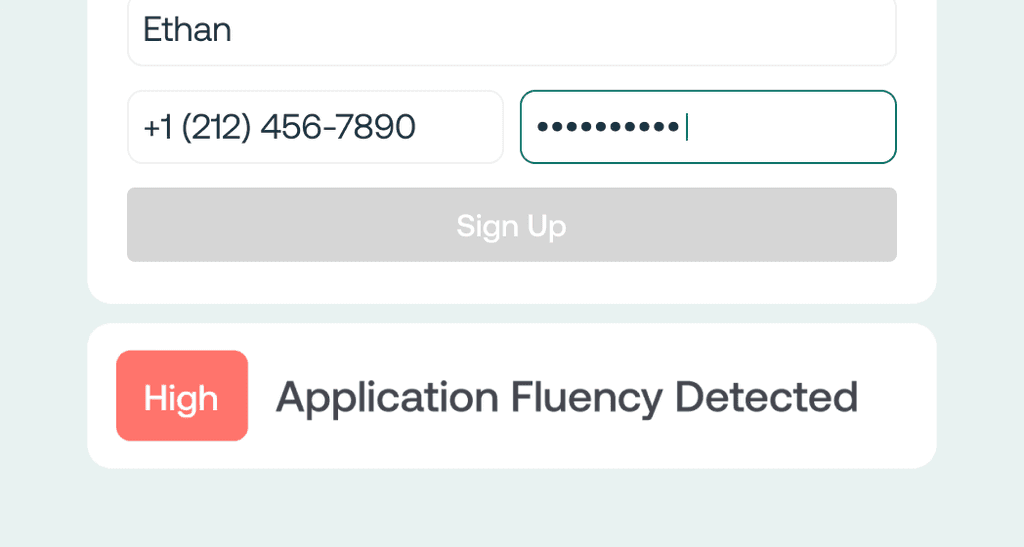

Account Creation

Block synthetic identities

Detect emulators and virtual machines

Stop automated account creation

Authentication

Payments

Fund Movement

Account Creation

Block synthetic identities

Detect emulators and virtual machines

Stop automated account creation

Authentication

Payments

Fund Movement

Account Creation

Block synthetic identities

Detect emulators and virtual machines

Stop automated account creation

Authentication

Payments

Fund Movement

Account Creation

Block synthetic identities

Detect emulators and virtual machines

Stop automated account creation

Authentication

Payments

Fund Movement

Account Creation

Block synthetic identities

Detect emulators and virtual machines

Stop automated account creation

Authentication

Payments

Fund Movement

Use Cases

Stop complex fraud patterns across many dimensions.

Oscilar's Cognitive Identity Intelligence Platform is already protecting some of the most sophisticated digital businesses across a range of areas.

Use Cases

Stop complex fraud patterns across many dimensions.

Oscilar's Cognitive Identity Intelligence Platform is already protecting some of the most sophisticated digital businesses across a range of areas.

Use Cases

Stop complex fraud patterns across many dimensions.

Oscilar's Cognitive Identity Intelligence Platform is already protecting some of the most sophisticated digital businesses across a range of areas.

Use Cases

Stop complex fraud patterns across many dimensions.

Oscilar's Cognitive Identity Intelligence Platform is already protecting some of the most sophisticated digital businesses across a range of areas.

Use Cases

Stop complex fraud patterns across many dimensions.

Oscilar's Cognitive Identity Intelligence Platform is already protecting some of the most sophisticated digital businesses across a range of areas.

Bot Prevention and Management

KYC

Account Takeover

Account Sharing

Payment Fraud

AML

API Defense

Compute Abuse

New Account Security

Account Sharing

"At Happy Money, protecting applicants from fraud while maintaining a simple, transparent experience for our more than 300,000 members is essential to our mission of empowering people to achieve their goals through responsible lending. Oscilar's Cognitive Identity Intelligence Platform helps us achieve this balance. Their advanced security-aware SDK passively monitors thousands of cognitive signatures to detect suspicious patterns during loan applications and account management, without adding unnecessary friction. By catching sophisticated synthetic identities and fraud attempts without impacting legitimate applicants, Oscilar helps us maintain trust and safeguard the capital we lend to support stronger, financially healthy futures."

Angela Kernell

Manager, Fraud Operations

"At Happy Money, protecting applicants from fraud while maintaining a simple, transparent experience for our more than 300,000 members is essential to our mission of empowering people to achieve their goals through responsible lending. Oscilar's Cognitive Identity Intelligence Platform helps us achieve this balance. Their advanced security-aware SDK passively monitors thousands of cognitive signatures to detect suspicious patterns during loan applications and account management, without adding unnecessary friction. By catching sophisticated synthetic identities and fraud attempts without impacting legitimate applicants, Oscilar helps us maintain trust and safeguard the capital we lend to support stronger, financially healthy futures."

Angela Kernell

Manager, Fraud Operations

"At Happy Money, protecting applicants from fraud while maintaining a simple, transparent experience for our more than 300,000 members is essential to our mission of empowering people to achieve their goals through responsible lending. Oscilar's Cognitive Identity Intelligence Platform helps us achieve this balance. Their advanced security-aware SDK passively monitors thousands of cognitive signatures to detect suspicious patterns during loan applications and account management, without adding unnecessary friction. By catching sophisticated synthetic identities and fraud attempts without impacting legitimate applicants, Oscilar helps us maintain trust and safeguard the capital we lend to support stronger, financially healthy futures."

Angela Kernell

Manager, Fraud Operations

"At Happy Money, protecting applicants from fraud while maintaining a simple, transparent experience for our more than 300,000 members is essential to our mission of empowering people to achieve their goals through responsible lending. Oscilar's Cognitive Identity Intelligence Platform helps us achieve this balance. Their advanced security-aware SDK passively monitors thousands of cognitive signatures to detect suspicious patterns during loan applications and account management, without adding unnecessary friction. By catching sophisticated synthetic identities and fraud attempts without impacting legitimate applicants, Oscilar helps us maintain trust and safeguard the capital we lend to support stronger, financially healthy futures."

Angela Kernell

Manager, Fraud Operations

"At Happy Money, protecting applicants from fraud while maintaining a simple, transparent experience for our more than 300,000 members is essential to our mission of empowering people to achieve their goals through responsible lending. Oscilar's Cognitive Identity Intelligence Platform helps us achieve this balance. Their advanced security-aware SDK passively monitors thousands of cognitive signatures to detect suspicious patterns during loan applications and account management, without adding unnecessary friction. By catching sophisticated synthetic identities and fraud attempts without impacting legitimate applicants, Oscilar helps us maintain trust and safeguard the capital we lend to support stronger, financially healthy futures."

Angela Kernell

Manager, Fraud Operations

impact

Improve your user’s experience, and your bottom line.

Stop losing genuine customers to overly aggressive fraud prevention. Oscilar’s Cognitive Identity Intelligence Platform works silently in the background, analyzing thousands of behavioral signals to recognize trusted users instantly while maintaining strong security against real threats.

impact

Improve your user’s experience, and your bottom line.

Stop losing genuine customers to overly aggressive fraud prevention. Oscilar’s Cognitive Identity Intelligence Platform works silently in the background, analyzing thousands of behavioral signals to recognize trusted users instantly while maintaining strong security against real threats.

impact

Improve your user’s experience, and your bottom line.

Stop losing genuine customers to overly aggressive fraud prevention. Oscilar’s Cognitive Identity Intelligence Platform works silently in the background, analyzing thousands of behavioral signals to recognize trusted users instantly while maintaining strong security against real threats.

impact

Improve your user’s experience, and your bottom line.

Stop losing genuine customers to overly aggressive fraud prevention. Oscilar’s Cognitive Identity Intelligence Platform works silently in the background, analyzing thousands of behavioral signals to recognize trusted users instantly while maintaining strong security against real threats.

impact

Improve your user’s experience, and your bottom line.

Stop losing genuine customers to overly aggressive fraud prevention. Oscilar’s Cognitive Identity Intelligence Platform works silently in the background, analyzing thousands of behavioral signals to recognize trusted users instantly while maintaining strong security against real threats.

Reduce Cart Abandonment

Dynamic risk scoring eliminates unnecessary verification steps at checkout, reducing cart abandonment. Let good customers complete purchases instantly while maintaining protection against fraudulent transactions.

Reduce Cart Abandonment

Dynamic risk scoring eliminates unnecessary verification steps at checkout, reducing cart abandonment. Let good customers complete purchases instantly while maintaining protection against fraudulent transactions.

Reduce Cart Abandonment

Dynamic risk scoring eliminates unnecessary verification steps at checkout, reducing cart abandonment. Let good customers complete purchases instantly while maintaining protection against fraudulent transactions.

Reduce Cart Abandonment

Dynamic risk scoring eliminates unnecessary verification steps at checkout, reducing cart abandonment. Let good customers complete purchases instantly while maintaining protection against fraudulent transactions.

Reduce Cart Abandonment

Dynamic risk scoring eliminates unnecessary verification steps at checkout, reducing cart abandonment. Let good customers complete purchases instantly while maintaining protection against fraudulent transactions.

Enable Instant Access

Automatically recognize and fast-track trusted users and devices. Remove friction for legitimate customers by eliminating unnecessary security challenges while maintaining strong protection where it matters.

Enable Instant Access

Automatically recognize and fast-track trusted users and devices. Remove friction for legitimate customers by eliminating unnecessary security challenges while maintaining strong protection where it matters.

Enable Instant Access

Automatically recognize and fast-track trusted users and devices. Remove friction for legitimate customers by eliminating unnecessary security challenges while maintaining strong protection where it matters.

Enable Instant Access

Automatically recognize and fast-track trusted users and devices. Remove friction for legitimate customers by eliminating unnecessary security challenges while maintaining strong protection where it matters.

Enable Instant Access

Automatically recognize and fast-track trusted users and devices. Remove friction for legitimate customers by eliminating unnecessary security challenges while maintaining strong protection where it matters.

Reward Customer Loyalty

Build customer trust by offering higher limits and instant approvals to proven users. Our intelligent system learns customer patterns over time, enabling you to provide VIP experiences without compromising security.

Reward Customer Loyalty

Build customer trust by offering higher limits and instant approvals to proven users. Our intelligent system learns customer patterns over time, enabling you to provide VIP experiences without compromising security.

Reward Customer Loyalty

Build customer trust by offering higher limits and instant approvals to proven users. Our intelligent system learns customer patterns over time, enabling you to provide VIP experiences without compromising security.

Reward Customer Loyalty

Build customer trust by offering higher limits and instant approvals to proven users. Our intelligent system learns customer patterns over time, enabling you to provide VIP experiences without compromising security.

Reward Customer Loyalty

Build customer trust by offering higher limits and instant approvals to proven users. Our intelligent system learns customer patterns over time, enabling you to provide VIP experiences without compromising security.

BankCo

Login

workemail@acme.com

•••••••••••••••

Continue

Forgot your password? Reset

Proxy IP

Distant time zone

Emulated device

Approve

Decision

Allow + continue monitoring

Decision

Step-up Login (MFA)

High Risk

Decision

Reset password + text customer

Decline

BankCo

Login

workemail@acme.com

•••••••••••••••

Continue

Forgot your password? Reset

Proxy IP

Distant time zone

Emulated device

Approve

High Risk

Decline

Decision

Allow + continue monitoring

Decision

Step-up Login (MFA)

Decision

Reset password + text customer

BankCo

Login

workemail@acme.com

•••••••••••••••

Continue

Forgot your password? Reset

Proxy IP

Distant time zone

Emulated device

Approve

High Risk

Decline

Decision

Allow + continue monitoring

Decision

Step-up Login (MFA)

Decision

Reset password + text customer

Implementation

Get started in minutes: enterprise security made simple.

Deploy enterprise-grade fraud prevention in days, not months. Our lightweight SDK requires just one line of code to get started, with pre-built connectors and flexible APIs that adapt to your needs. Most clients begin seeing actionable insights within hours of deployment, backed by 24/7 expert support and continuous optimization.

Implementation

Get started in minutes: enterprise security made simple.

Deploy enterprise-grade fraud prevention in days, not months. Our lightweight SDK requires just one line of code to get started, with pre-built connectors and flexible APIs that adapt to your needs. Most clients begin seeing actionable insights within hours of deployment, backed by 24/7 expert support and continuous optimization.

Implementation

Get started in minutes: enterprise security made simple.

Deploy enterprise-grade fraud prevention in days, not months. Our lightweight SDK requires just one line of code to get started, with pre-built connectors and flexible APIs that adapt to your needs. Most clients begin seeing actionable insights within hours of deployment, backed by 24/7 expert support and continuous optimization.

Implementation

Get started in minutes: enterprise security made simple.

Deploy enterprise-grade fraud prevention in days, not months. Our lightweight SDK requires just one line of code to get started, with pre-built connectors and flexible APIs that adapt to your needs. Most clients begin seeing actionable insights within hours of deployment, backed by 24/7 expert support and continuous optimization.

Implementation

Get started in minutes: enterprise security made simple.

Deploy enterprise-grade fraud prevention in days, not months. Our lightweight SDK requires just one line of code to get started, with pre-built connectors and flexible APIs that adapt to your needs. Most clients begin seeing actionable insights within hours of deployment, backed by 24/7 expert support and continuous optimization.

Reduce Cart Abandonment

Reduce Cart Abandonment

Reduce Cart Abandonment

Reduce Cart Abandonment

Reduce Cart Abandonment

One-line SDK integration for web and mobile applications

Cloud-native architecture that works with your existing infrastructure

Pre-built platform connectors for major fraud prevention platforms

Flexible APIs for seamless implementation

One-line SDK integration for web and mobile applications

Cloud-native architecture that works with your existing infrastructure

Pre-built platform connectors for major fraud prevention platforms

Flexible APIs for seamless implementation

One-line SDK integration for web and mobile applications

Cloud-native architecture that works with your existing infrastructure

Pre-built platform connectors for major fraud prevention platforms

Flexible APIs for seamless implementation

One-line SDK integration for web and mobile applications

Cloud-native architecture that works with your existing infrastructure

Pre-built platform connectors for major fraud prevention platforms

Flexible APIs for seamless implementation

One-line SDK integration for web and mobile applications

Cloud-native architecture that works with your existing infrastructure

Pre-built platform connectors for major fraud prevention platforms

Flexible APIs for seamless implementation

Immediate Impact

Immediate Impact

Immediate Impact

Immediate Impact

Immediate Impact

Same-day actionable insights

Real-time protection against current and emerging threats

Continuous learning tailored to your user patterns and attack vectors

Progressive enhancement of security measures based on risk profile

Same-day actionable insights

Real-time protection against current and emerging threats

Continuous learning tailored to your user patterns and attack vectors

Progressive enhancement of security measures based on risk profile

Same-day actionable insights

Real-time protection against current and emerging threats

Continuous learning tailored to your user patterns and attack vectors

Progressive enhancement of security measures based on risk profile

Same-day actionable insights

Real-time protection against current and emerging threats

Continuous learning tailored to your user patterns and attack vectors

Progressive enhancement of security measures based on risk profile

Same-day actionable insights

Real-time protection against current and emerging threats

Continuous learning tailored to your user patterns and attack vectors

Progressive enhancement of security measures based on risk profile

Expert Support

Expert Support

Expert Support

Expert Support

Expert Support

Dedicated implementation team

24/7 technical assistance

Threat intelligence updates

Optimization consulting

Dedicated implementation team

24/7 technical assistance

Threat intelligence updates

Optimization consulting

Dedicated implementation team

24/7 technical assistance

Threat intelligence updates

Optimization consulting

Dedicated implementation team

24/7 technical assistance

Threat intelligence updates

Optimization consulting

Dedicated implementation team

24/7 technical assistance

Threat intelligence updates

Optimization consulting

©2025 Oscilar, Inc. All rights reserved.

©2025 Oscilar, Inc. All rights reserved.

©2025 Oscilar, Inc. All rights reserved.

See Oscilar in action.

©2025 Oscilar, Inc. All rights reserved.

©2025 Oscilar, Inc. All rights reserved.