Last updated: January 2026

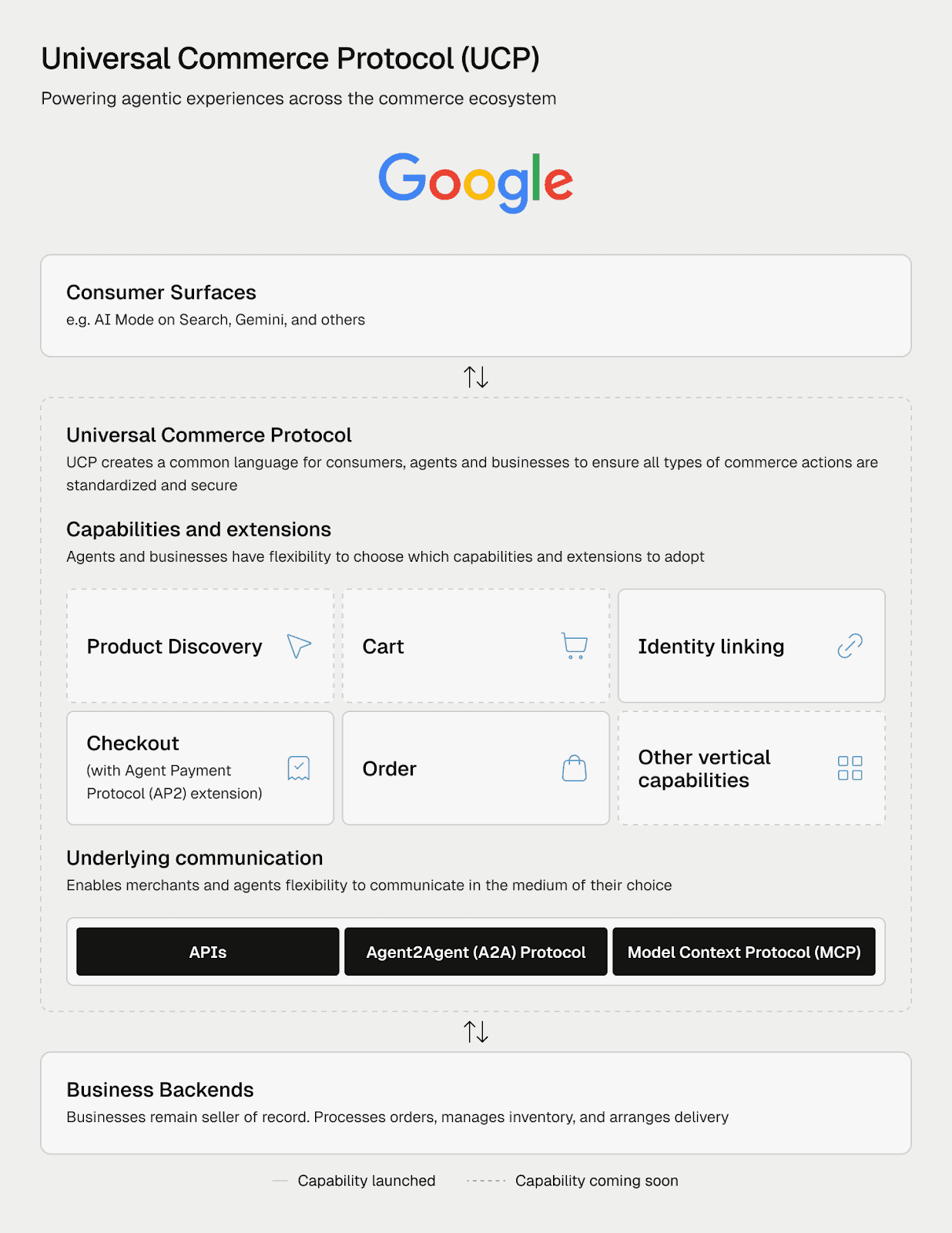

Google just unveiled the Universal Commerce Protocol at the National Retail Federation conference, an open-source standard that could become the invisible infrastructure layer for every AI-mediated purchase on earth.

Co-developed with Shopify, Target, Walmart, Etsy, and Wayfair, and endorsed by Visa, Mastercard, Stripe, and American Express, this protocol enables AI agents to autonomously handle discovery, checkout, payments, returns, and loyalty rewards without human intervention.

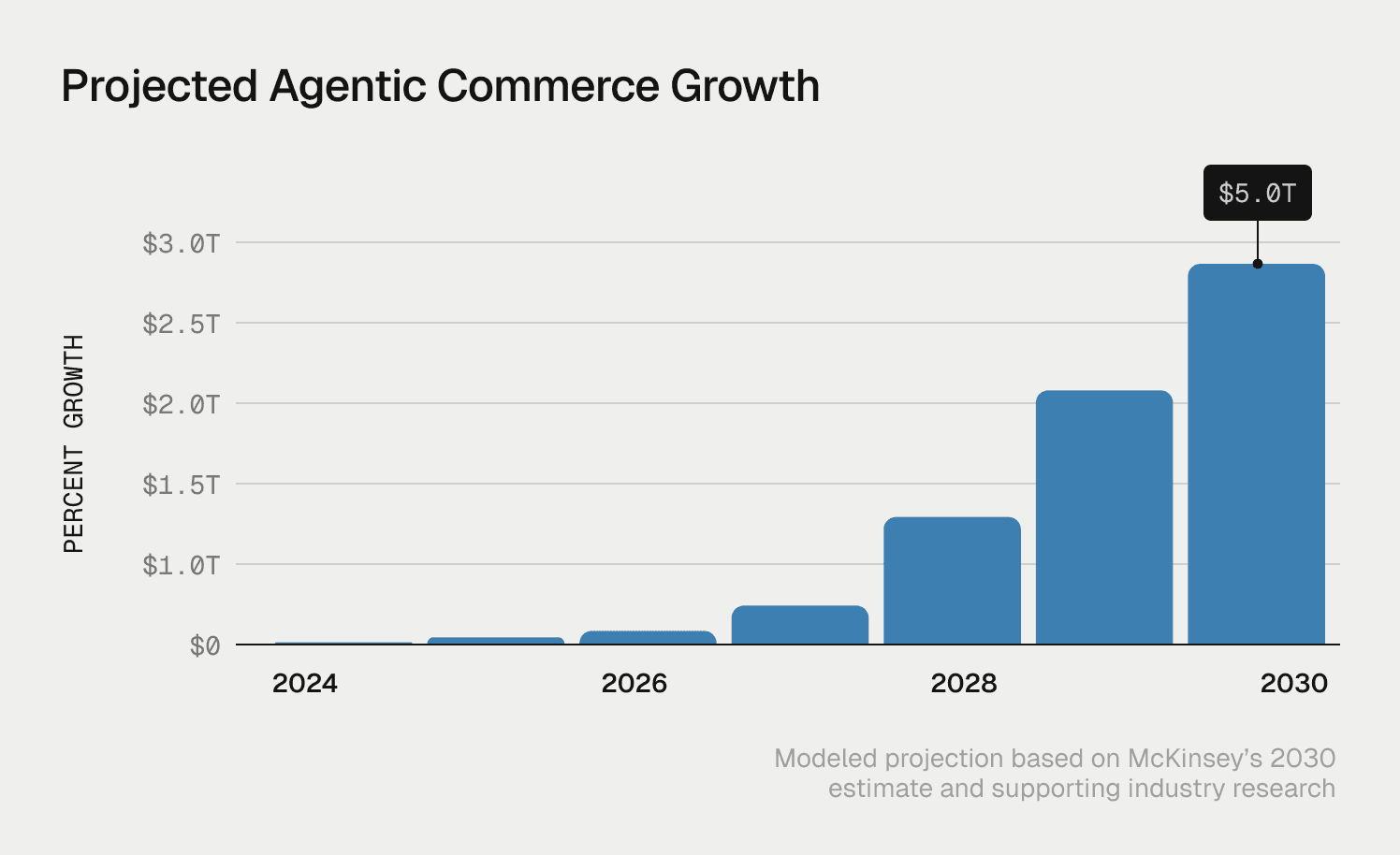

McKinsey projects that $3 to $5 trillion in global commerce could flow through AI agents by 2030. The Universal Commerce Protocol is Google’s bid to become the rails on which that future runs.

TL;DR

Google’s Universal Commerce Protocol lets AI agents handle shopping tasks like finding products, checking out, handling payments, returns, and loyalty

The protocol replaces one-off merchant integrations with a single shared standard, making it easier for AI agents to buy from many retailers

Brands compete less on ads and website design and more on clean data, reliable inventory, and fulfillment performance

Payment companies like Visa, Mastercard, and Stripe are shifting focus from checkout fees to verifying agents and managing risk

AI-driven commerce needs AI-native trust systems, including ways to verify AI agents, confirm user permission, and detect fraud

What problem does the Universal Commerce Protocol actually solve?

Today, every AI platform, whether ChatGPT, Google AI Mode, or Perplexity AI,would require custom integrations with every merchant to enable autonomous purchasing.

Engineers refer to this as the N×N problem, and it is fundamentally unscalable.

According to Google’s technical documentation, UCP collapses N×N complexity into a single integration point by introducing a standardized commerce language.Merchants publish their capabilities at a known endpoint andAI agents dynamically discover what each merchant supports without hardcoded integrations.

When a user says “find me a lightweight suitcase,” an AI agent queries Google’s Shopping Graph,which contains over 50 billion product listings refreshed more than 2 billion times hourly,and generates parallel searches across price, brands, reviews, shipping times, and availability.

This is the difference between AI assisting commerce and AI operating commerce.

How will brands compete when AI agents control discovery?

Brands now face a paradox: they are simultaneously more important and less visible.

When AI agents mediate discovery, traditional brand experiences like websites, packaging aesthetics, and in-store environments matter less. Differentiation shifts from persuasive marketing messages to structured data that agents can parse.

BCG research warns that without swift intervention, retailers risk being reduced to undifferentiated utilities inside agent-controlled marketplaces.

At the same time, operational excellence becomes the competitive moat. AI agents remember every merchant interaction. Accurate inventory, reliable fulfillment, and consistent quality compound into trust signals that drive default recommendations.

Adobe data shows traffic to U.S. retail sites from generative AI sources surged 4,700% year-over-year in July 2025, with visitors spending 32% more time on site with 27% lower bounce rates.

What the Universal Commerce Protocol means for Visa, Mastercard, and Stripe

The Universal Commerce Protocol commoditizes the checkout layer that traditional payment providers once controlled.

Value shifts upstream to identity verification, authorization, and risk assessment. Visa has responded with the Trusted Agent Protocol, developed in collaboration with Cloudflare, which cryptographically verifies that an AI agent is legitimate and acting on a user’s behalf. Visa issues agent-linked payment tokens that function like credit cards for AI agents, linked to the consumer’s original account.

According to Visa’s December announcement, hundreds of secure agent-initiated transactions have already been completed in production.

In an agentic economy, payment providers competing solely on transaction fees face margin compression. The winners will differentiate on trust infrastructure, global coverage, and risk intelligence.

Why trust is the fundamental barrier to agentic commerce adoption

According to Bain & Company research, only 24% of U.S. consumers feel comfortable using AI to complete purchases today. Accenture’s Future of Money study found that 78% of financial institution leaders expect fraud to increase significantly due to agentic commerce. New fraud vectors include agent impersonation, consent manipulation, data poisoning, and prompt injection attacks hidden in product descriptions.

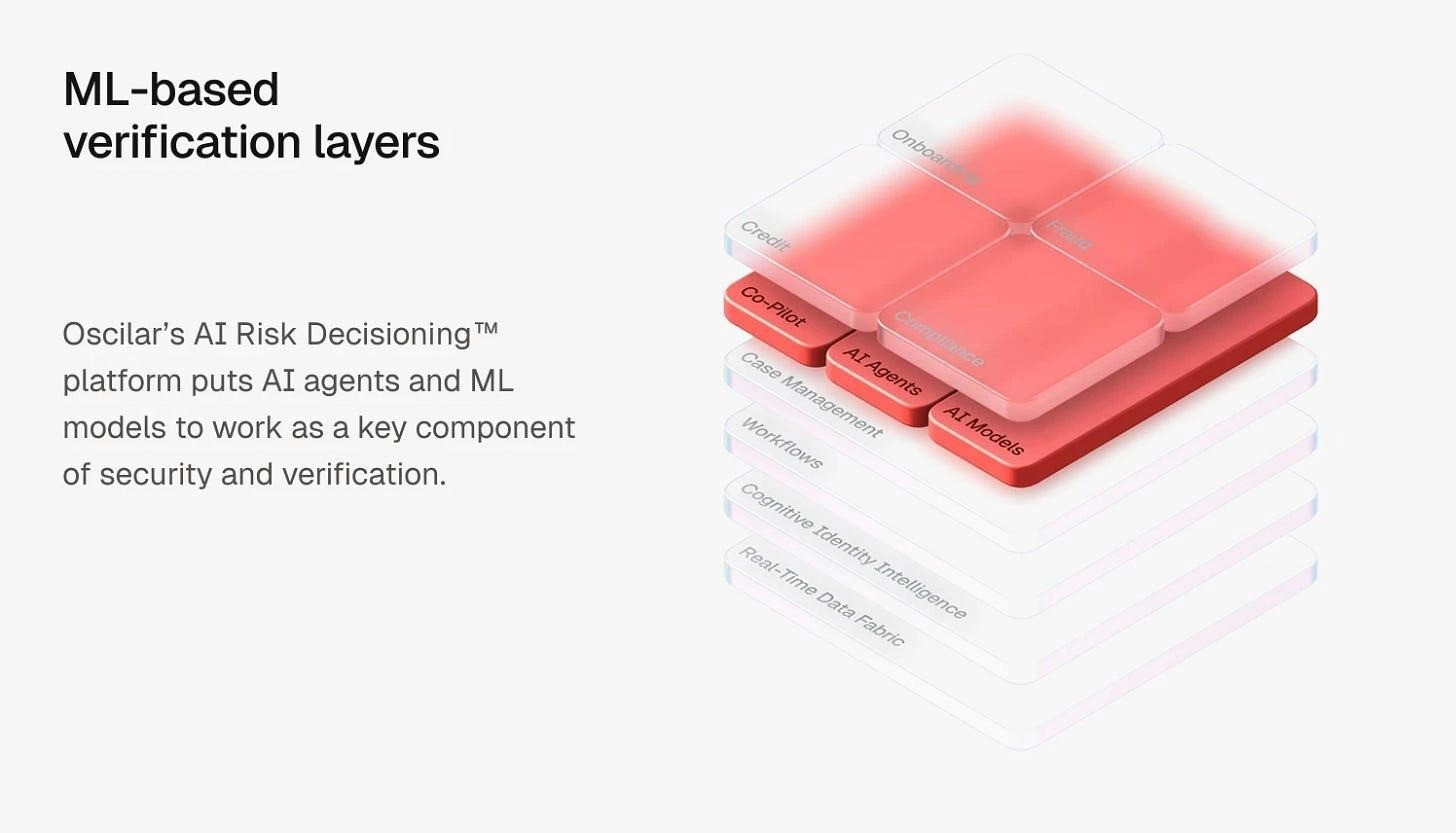

This is why companies like Oscilar will become increasingly critical, providing the real-time risk, fraud detection, and authorization controls needed to secure autonomous, AI-driven transactions.

Why agentic commerce requires reimagined risk infrastructure

Agentic commerce introduces risks that existing systems were never designed to handle. When transactions are initiated and executed by AI agents, trust can no longer rely on controls built for human behavior. A new risk model is required.

Components of this new risk infrastructure include:

Know Your Agent (KYA): Just as KYC verifies customers, systems must verify AI agents. Risk, compliance, and identity providers will need to adapt existing KYC and AML frameworks to identify, authenticate, and monitor non-human actors.

Real-time behavioral analysis: Legacy fraud tools analyze human behavior. AI agents require different signals, such as transaction velocity, API usage patterns, and anomalous capability execution.Cryptographic consent verification: The Universal Commerce Protocol’s AP2 extension supports “mandates,” which are cryptographically signed records proving user authorization. These mandates create auditable trails for disputes and compliance.

Continuous authentication: Unlike one-time checkout authentication, agent-mediated commerce requires ongoing verification throughout the full transaction lifecycle.

This is where platforms like Oscilar become critical. Oscilar’s AI Risk Decisioning™ platform adds real-time intelligence to detect fraud, anomalies, and compliance issues in machine-initiated transactions, filling the trust gap created by autonomous commerce.

Together, protocols like the Universal Commerce Protocol and Trusted Agent Protocol, combined with AI-native risk decisioning, form the emerging trust stack of agentic commerce.

The urgency is clear. Accenture research shows that 85% of financial institutions believe their current systems are not equipped to handle high-volume, agent-initiated transactions, and 60% lack a dedicated response plan for agent-driven fraud.

What happens next as agentic commerce moves into production

Agentic commerce is moving quickly from experimentation to real-world deployment. Over the next few years, the biggest changes will come in waves, as infrastructure providers, merchants, and regulators respond to AI agents becoming active participants in commerce.

2026–2027: Rapid adoption and early disruption

In the near term, payment and commerce infrastructure providers will move quickly to integrate with Google’s Universal Commerce Protocol. For many, this is a requirement to remain compatible with AI agents.

As reported by TechCrunch, the protocol already works with existing standards such as Agent2Agent, Agent Payments Protocol, and Model Context Protocol, which lowers the technical barrier to adoption and speeds up integration timelines.

As agent-driven purchases grow, demand for AI-native fraud and risk platforms will increase, since legacy systems are built for human behavior. Comparison and affiliate sites will lose relevance, while merchants invest more in clean product data, accurate inventory, and better APIs.

2027–2029: Consolidation, trust, and regulation

By the late 2020s, protocol consolidation becomes unavoidable. Either the Universal Commerce Protocol becomes the default, or fragmentation recreates the same problems at the integration level.

New markets will form around agent verification, authorization, and risk scoring, making trust as important as payment processing. Regulators will step in, with European authorities already examining Google’s influence.

What’s next for agentic commerce

Google is not playing for transaction fees. It is playing for infrastructure primacy.

Controlling the protocol layer means even when purchases happen through OpenAI’s ChatGPT or Amazon’s Alexa, those agents must speak Universal Commerce Protocol to access the merchant ecosystem.

As Shopify CEO Tobi Lütke noted at the announcement, agentic commerce enables “serendipity” where AI finds products consumers would never have searched for themselves“and this kind of serendipity is where the best of commerce happens.”

So the trillion-dollar question is not whether agentic commerce happens. It is whether commerce infrastructure consolidates around one protocol or fragments across many.

Google has engineered the Universal Commerce Protocol as the HTTP of shopping: open, extensible, and economically aligned with ecosystem growth.

History suggests that is exactly how winning infrastructure protocols behave.