2025 foi um ano de destaque para Oscilar. Passamos de uma visão ambiciosa para um desempenho comprovado dentro de alguns dos ambientes financeiros mais exigentes do mundo. Nossos agentes de IA construídos para finanças em tempo real foram colocados em produção, nossa presença cresceu em alguns dos mercados de mais rápido crescimento do mundo, e nossa tecnologia e pessoas foram homenageadas pelas principais vozes do setor.

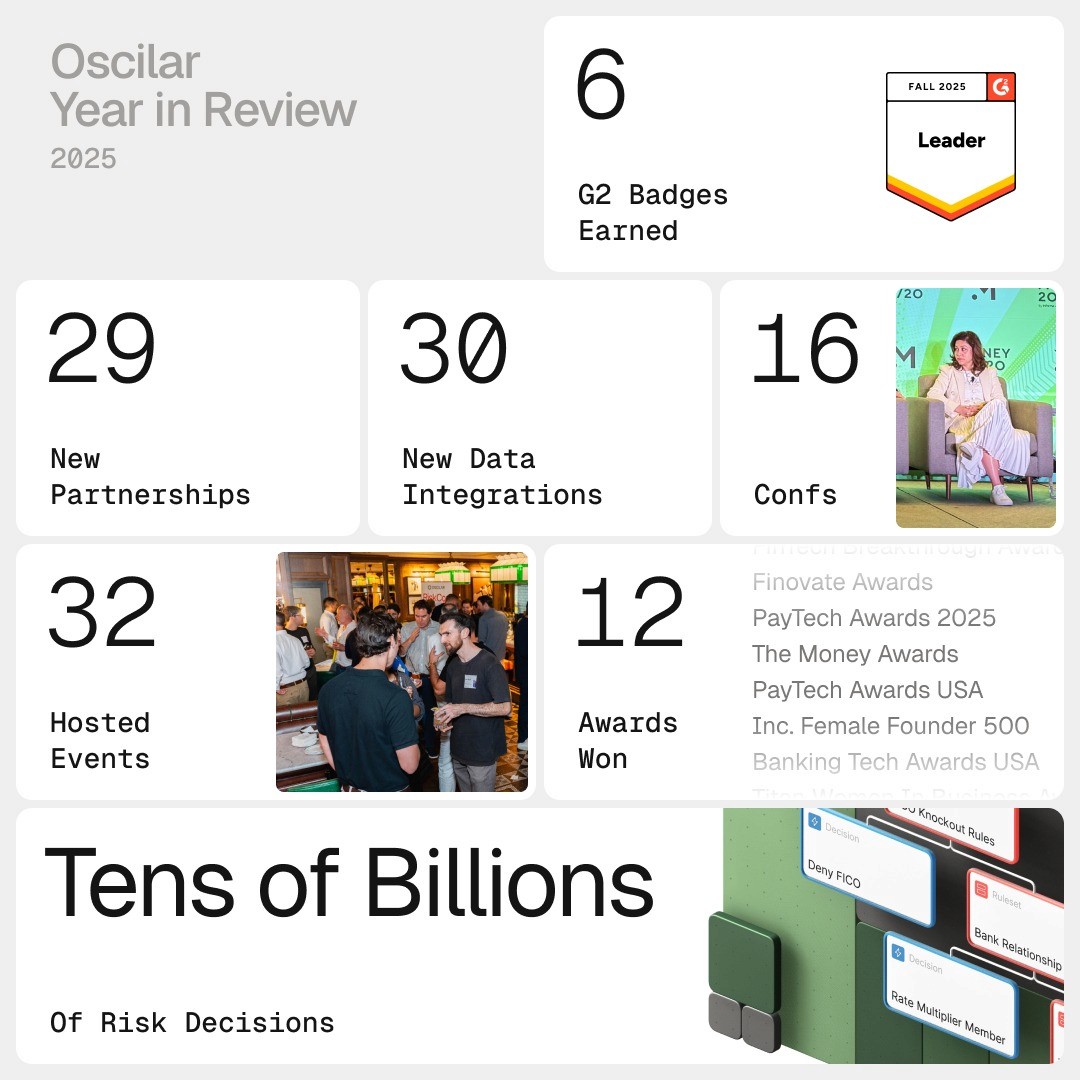

No nível da plataforma, Oscilar executou dezenas de bilhões de decisões de risco em tempo real, integrou 30 novos parceiros de dados e suportou um conjunto crescente de casos de uso financeiro. Bancos líderes, cooperativas de crédito, fintechs e plataformas de criptomoeda confiaram na plataforma AI Risk Decisioning™ da Oscilar para modernizar a prevenção de fraude, análise de crédito e conformidade AML — operando mais rápido e com mais precisão em escala, sem sacrificar controle ou explicabilidade.

Também reunimos a comunidade global de risco com 32 eventos em três continentes: criando espaço para operadores, construtores e visionários compartilharem o que está funcionando em escala.

O que lançamos em 2025 agora está funcionando nos bastidores das finanças modernas. Em 2026, nosso foco muda de provar que funciona para empurrar até onde pode ir.

Resumindo

Lançamos nossa plataforma de agentes de IA com quatro novos agentes implantados: Análise de Documentos, Gerador de Casos de Teste, Tradução e Triagem AML L1

Processamos dezenas de bilhões de decisões de risco em tempo real enquanto integrávamos mais de 30 novas fontes de dados e aprimorávamos as capacidades de processo sem código

Principais conquistas com clientes: SoFi (50% mais rápido para entrar no mercado), MoneyGram (modernização global de AML), Nuvei (aumento de 15% na adjudicação automática), Payoneer (desbloqueando inteligência de fraude em tempo real) e Clara (onboarding 3x mais rápido durante o hiper crescimento)

Expandimos o ecossistema de parceiros com 29 novas parcerias, incluindo Mastercard Engage e a rede de parceiros preferenciais da Nacha

Ganhamos 12 prestigiados prêmios do setor em Banking, AML e IA incluindo prêmios do Money20/20's Money Awards, Finovate, FinTech Futures, Datos Research e mais

Hospedamos 32 eventos em 3 continentes, incluindo 7 reuniões RiskCon, 16 jantares executivos e missões paralelas em grandes eventos do setor como Money20/20 EUA e Europa

Entrando em 2026 com novos agentes de IA em desenvolvimento, presença global expandida e aparições confirmadas em mais de 8 grandes eventos do setor

Avançando a plataforma Oscilar

Em 2025, focamos em tornar a Oscilar mais rápida, mais autônoma e mais fácil de usar em escala. As melhorias da plataforma foram centradas na expansão de capacidades baseadas em IA, na redução do atrito operacional para equipes de risco e no fortalecimento da base de dados que alimenta as decisões em tempo real.

Lançamento de nossa plataforma de agentes de IA

Em março, revelamos a plataforma de IA agentic da Oscilar construída em torno de agentes de IA especializados projetados para estender e apoiar as equipes de risco. E com isso, quatro novos agentes:

Agente de Análise de Documentos para automatizar a revisão e extração de documentos KYC

Gerador de Casos de Teste para criar e validar lógica de regras em escala

Agente de Tradução para interpretar sinais de fraude globais em tempo real

Agente de Triagem AML L1 para priorizar alertas de conformidade com contexto e confiança

Esses agentes foram projetados para lidar com o trabalho repetitivo e de alto volume que desacelera as equipes, enquanto mantém os humanos firmemente no controle do julgamento, política e escalonamento.

Ao contrário de modelos estáticos que aguardam entradas e produzem pontuações opacas, os agentes de IA da Oscilar trabalham continuamente nos bastidores. Eles unificam dados de risco em sistemas, evidenciam sinais emergentes e refinam avaliações em tempo real, tudo enquanto operam sob governança guiada por humanos. Cada decisão permanece explicável, auditável e configurável pelas equipes responsáveis por gerenciar o risco.

Juntos, esses agentes absorveram o trabalho repetitivo e intensivo de tempo que desacelera as equipes de risco, liberando especialistas para se concentrar no julgamento, na estratégia e nas decisões complexas onde a percepção humana é mais importante.

"Nossos Agentes de IA não apenas processam dados; eles entendem os objetivos de negócios, determinam independentemente fatores de risco relevantes e aprendem continuamente com interações para melhorar sua eficácia", disse Neha Narkhede, Co-Fundadora e CEO da Oscilar.

E isso é apenas o começo. Mais agentes estão chegando em 2026.

Mais de 30 novas fontes de dados, sem engenharia personalizada necessária

Em 2025, expandimos significativamente o ecossistema de dados da Oscilar, adicionando mais de 30 integrações de terceiros projetadas para operar em velocidades de tempo real. Nossa arquitetura agnóstica de fornecedores permite que as equipes conectem inteligência de dispositivos, verificação de identidade, escritórios de crédito e outros sinais externos diretamente em fluxos de decisão ao vivo, sem engenharia personalizada ou desacelerações operacionais.

Em produção: Clara, uma fintech líder servindo a América Latina, implementou Oscilar com 15 integrações externas. Oscilar agora alimenta mais de 700.000 decisões em tempo real, cada uma executada de ponta a ponta em menos de 800 milissegundos, tudo sem interromper jornadas de clientes.

Evolução do processo sem código

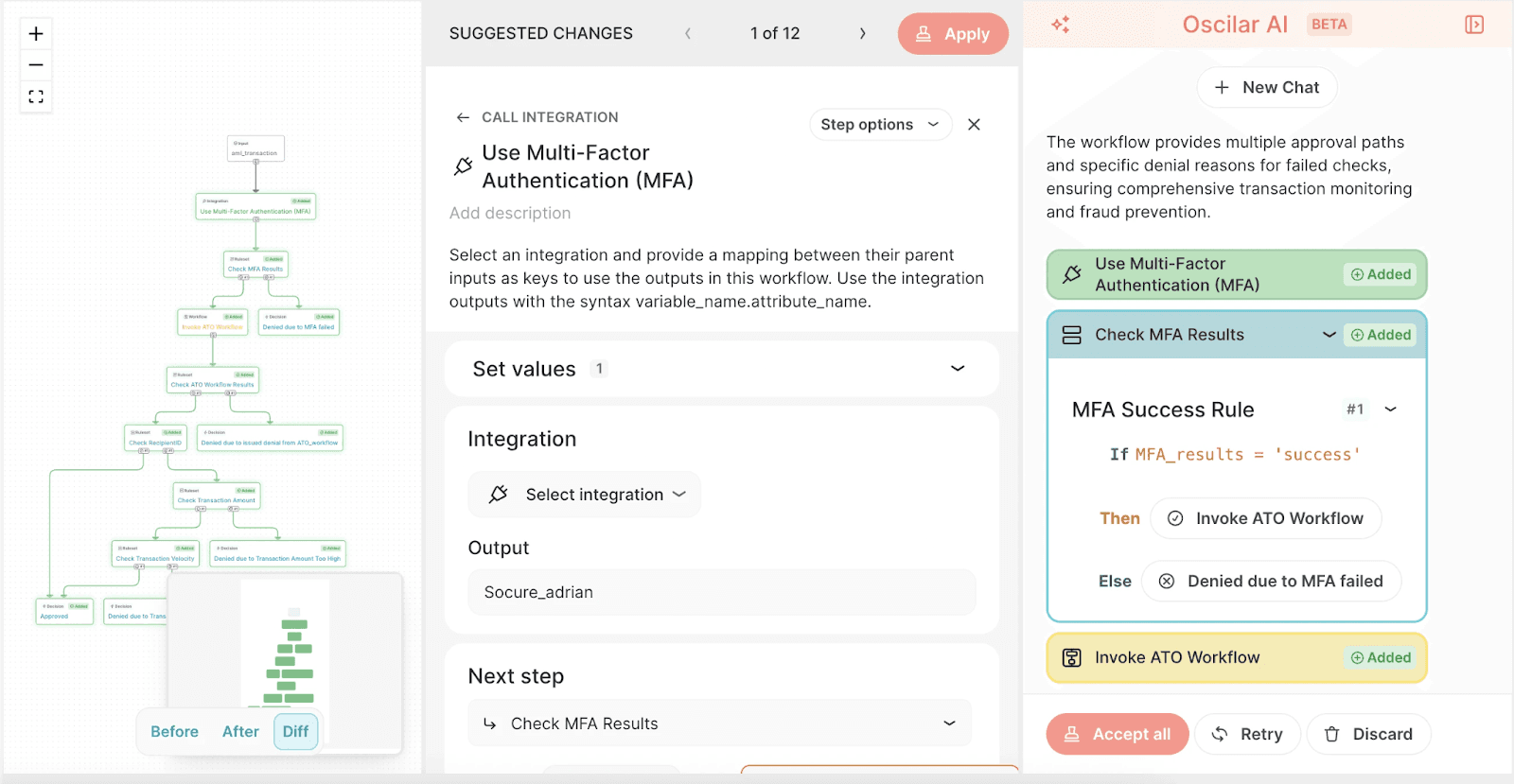

Entregamos grandes aprimoramentos às capacidades de processo sem código da Oscilar para ajudar as equipes a se movimentarem mais rapidamente, incluindo um construtor de políticas e um motor de regras em linguagem natural. As equipes de risco agora podem construir, testar e iterar processos usando ferramentas de arrastar e soltar e ambientes de retroalimentação, reduzindo ciclos de iteração de semanas para horas.

Em setembro, introduzimos nosso Copiloto de Processo de IA, permitindo que as equipes construam regras de risco em inglês simples. Em vez de buscar variáveis e escrever scripts personalizados, as equipes agora digitam o que querem: "Marcar logins de novos dispositivos após mudanças de senha" ou "Bloquear todas as aplicações de conta onde um ID de dispositivo é comum para mais de três contas nos últimos sete dias" e assistem à IA gerar processos completos.

Usuários beta iniciais viram uma construção de processos 80% mais rápida. Uma equipe substituiu mais de 20 regras e um script personalizado em uma única tarde. Essa flexibilidade também permitiu que clientes da Oscilar como a SoFi lançassem e refinassem estratégias de crédito rapidamente sem depender de recursos de desenvolvedor.

Desempenho que escala com você

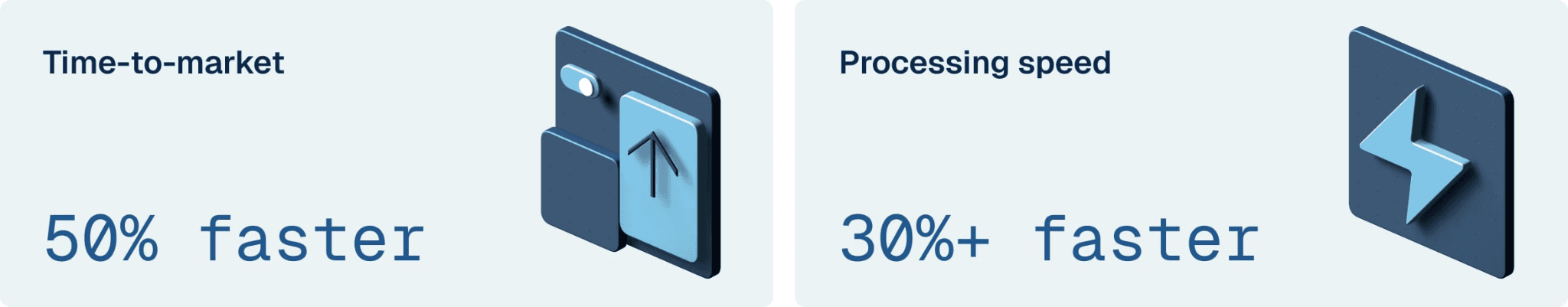

Impulsionamos o desempenho da plataforma ainda mais em 2025, alcançando 50% de latência P99 mais rápida com tempos de resposta abaixo de 200ms em escala. Nossos SDKs para iOS ficaram 80% menores, mantendo os padrões de segurança que nossa tecnologia de ofuscação entregou por anos.

Atualizando a marca Oscilar

Em 2025, debutamos uma identidade visual totalmente nova e um site para melhor refletir a escala e maturidade de nossa plataforma. A rebrand introduziu um sistema de design modular em 3D, logotipos renovados construídos em torno de Oscilar Vermillion, e uma nova fonte projetada para clareza e escala.

O projeto, liderado pelo Designer de Marca Principal Andrew Pons, foi concluído de ponta a ponta em menos de seis meses e entregou uma identidade de marca alinhada com onde estamos indo.

Clientes da Oscilar gerando impacto real

Instituições financeiras líderes confiam na Oscilar para modernizar operações de fraude, crédito e conformidade em escala. Em 2025, clientes em bancos, pagamentos, criptomoedas e fintech usaram a Oscilar para se mover mais rápido, reduzir atrito e tomar melhores decisões de risco em produção.

SoFi: Modernizando o risco ao longo de todo o ciclo de vida do cliente

SoFi, uma empresa de serviços financeiros digitais líder que atende a mais de 10 milhões de membros, fez parceria com Oscilar para consolidar a análise de crédito, cobrancas e decisões de fraude em nossa plataforma nativa de IA.

Resultados:

50% mais rápido para lançar novas políticas de risco (medido em dias em vez de semanas)

Melhoria de mais de 30% em velocidades de processamento em fluxos de decisão

Governança centralizada entre produtos bancários, de empréstimos e de investimento

"Podemos facilmente lançar e iterar novas políticas e adaptar com velocidade sem precedentes. Oscilar suporta a capacidade da SoFi de tomar decisões de risco rápidas e precisas e atender às necessidades de nossos membros." — Adam Colclasure, Diretor Sênior de Dados de Risco & Decisão, SoFi

MoneyGram: Modernizando a fraude e AML em pagamentos globais

MoneyGram International, operando em mais de 200 países e territórios, selecionou a Oscilar para modernizar sua infraestrutura de fraude e AML, consolidando sistemas anteriormente siloizados em uma única plataforma. Inteligência adaptativa de risco em tempo real agora está embutida diretamente em cada transação em sua rede de pagamentos globais.

"Estamos focados em colaborar com empresas nativas de IA como a Oscilar que estão ultrapassando seus pares e redefinindo o setor. Gestão de risco adaptativa e inteligente é essencial para acompanhar a complexidade e velocidade dos pagamentos globais." — Luke Tuttle, Diretor de Produto & Tecnologia, MoneyGram

Nuvei: Escalando pagamentos globais sem arrasto operacional

Nuvei, um provedor de pagamentos globais que atende comerciantes em mais de 200 mercados, implantou Oscilar para substituir uma pilha de risco fragmentada com uma única camada de decisão alimentada por IA.

Resultados:

Aumento de 15% na adjudicação automática no primeiro mês

50% mais rápido nos tempos de revisão manual de casos

Nenhum SLA perdido após a implementação

"Nunca perguntei à Oscilar por algo e recebi um não como resposta. Às vezes necessita de pesquisa ou novo desenvolvimento, mas a resposta sempre é sim. Esse nível de parceria é raro." — Daniel Hough, Diretor de Risco & Análise de Crédito, Nuvei

Payoneer: Inteligência de fraude em tempo real em escala global

Em dezembro, Payoneer (NASDAQ: PAYO), que suporta dezenas de bilhões em volume de transações através de mais de 7.000 corredores de comércio, selecionou Oscilar para modernizar a fraude e a inteligência de risco em seus sistemas principais.

"Estamos investindo em infraestrutura de detecção de fraude inteligente projetada para nossa escala e diversidade de clientes. A arquitetura de IA da Oscilar nos dá a agilidade para iterar rapidamente modelos e orquestrar estratégias de risco complexas." — Michael Sheehy, Diretor de Compliance, Payoneer

Clara: Automatizando a análise de crédito durante o hiper crescimento

Clara, uma fintech líder na América Latina que fornece cartões corporativos e gestão de despesas para mais de 20.000 empresas no México, Brasil e Colômbia, transformou suas operações de análise de crédito com a Oscilar, escalando rapidamente sem expandir o quadro de funcionários.

Resultados:

Onboarding de clientes 3x mais rápido

Aumento de 3-4x na capacidade de análise de crédito

Mais de 80 variantes de processo construídas pela equipe de risco usando ferramentas sem código

"Com a Oscilar, não estamos apenas implementando um produto. Estamos escrevendo o manual de como isso deve ser feito." — Gustavo Bottegoni, Diretor Global de Risco de Crédito, Clara

Ampliando nosso ecossistema global de parceiros

Em 2025, Oscilar expandiu significativamente sua rede de parceiros, formando 29 novas parcerias de consultoria e encaminhamento para acelerar a adoção e ampliar as capacidades da plataforma mundialmente.

Parceria com o Mastercard para acelerar a emissão digital

Oscilar juntou-se à rede de parceiros Mastercard Engage para suportar a emissão instantânea de cartões digitais. Ao combinar o AI Risk Decisioning™ da Oscilar com os programas Digital First e Engage da Mastercard, os emissores podem lançar cartões digitais mais rapidamente, enquanto melhoram a confiança e a experiência do cliente.

Oscilar nomeada parceira preferencial da Nacha antes das mudanças nas regras do ACH em 2026

Nacha, o órgão governante da rede ACH, define os padrões e regras para pagamentos ACH nos Estados Unidos. Oscilar foi reconhecida como Parceiro Preferencial da Nacha para Validação de Contas, Monitoramento de Fraude e Prevenção de Risco & Fraude antes das novas regras de fraude ACH entrarem em vigor em 2026.

Essa parceria traz decisão de risco em tempo real, nativa de IA, para instituições financeiras de todos os tamanhos, ajudando-as a cumprir os padrões de conformidade da Nacha com precisão.

América Latina está escolhendo infraestrutura nativa de IA

Oscilar fortaleceu sua presença em todo o Brasil e a América Latina por meio de parcerias com BigDataCorp, XC Group, e Decidir. Essas colaborações falam sobre um impulso mais amplo na região: de sistemas legados e baseados em regras para infraestrutura de risco projetada para a velocidade das finanças de hoje. Oscilar está sendo cada vez mais adotada como tecnologia central de decisão em mercados financeiros de rápido crescimento na região.

Reconhecimento da indústria e prêmios

Em 2025, o trabalho da Oscilar foi reconhecido em todo o cenário de risco e fintech, com prêmios abrangendo IA, decisão de risco, fraude, AML e conformidade. Para uma startup de quatro anos ser reconhecida ao lado de instituições estabelecidas há muito tempo e negociadas publicamente é um sinal significativo de que o que estamos construindo está ressoando.

Reconhecimento da plataforma

Prêmios Banking Tech — Melhor Solução de IA (Motor de Decisão)

Chartis Retail Banking Analytics 50 — Inovação em Plataformas de Decisão

Prêmios PayTech EUA — Melhor Solução de IA

The Money Awards — AML, Identidade & KYC (Banking)

Prêmios Finovate — Melhor Solução Anti-Fraude / AML

Datos — Melhor Inovação em Monitoramento de Transações AML & Fraude

Prêmios FinTech Breakthrough — Melhor Plataforma de Decisão de Risco

Chartis Financial Crime and Compliance 50 — Prêmio Plataforma Modular; Excelência Regional (Oriente Médio)

Reconhecimento de liderança: Neha Narkhede

Inc. Magazine — Female Founders 500

Prêmios Banking Tech EUA — Mulher na Tecnologia: Fundadora & CEO Visionária

Titan Women in Business Awards — CEO Excepcional

Obrigado aos jurados e equipes de prêmios por reconhecerem o poder de nossa plataforma e todas as mãos e trabalho árduo por trás dela.

Clientes ♥︎ Oscilar

Estamos honrados em ser reconhecidos pela G2 com vários distintivos em 2025, incluindo um distintivo de Líder em Gestão de Decisão.

"O que mais se destaca para mim é a força da parceria. A capacidade de resposta, compromisso e consistência da equipe realmente merece minha total confiança." — Avaliação G2

Essas avaliações vêm diretamente de clientes verificados reais que confiam na Oscilar para operar suas operações de risco.

Mostramos presença em todos os lugares (e você notou!)

Oscilar aumentou dramaticamente o nível de presença no ecossistema em 2025, hospedando e coorganizando 32 eventos em 13 cidades e três continentes. A intenção não era apenas visibilidade, mas criar espaços onde líderes de risco, fraude e conformidade pudessem ter conversas substanciais e off the record sobre o que está funcionando e o que não está.

RiskCon é o lugar para estar

Sete eventos principais RiskCon reuniram líderes de risco em grandes centros financeiros, incluindo Nova York, Atlanta, Cidade do México, São Paulo, Área da Baía e Londres. Cada evento foi centrado em desafios do mundo real: como as equipes estão se adaptando a novos padrões de fraude, pressão regulatória, e mudanças impulsionadas por IA.

Além de RiskCon, acolhemos:

16 jantares executivos, desenhados para discussões menores e sinceras entre líderes financeiros seniores, realizados em locais que vão desde o British Bankers Club até Nobu e estiatorio Milos

9 recepções e mesas redondas de networking, incluindo um encontro de casa cheia durante o Money20/20 Europa

Os participantes nos dizem que hospedamos os melhores eventos em fintech.

Um ano muito ocupado (e muito divertido) na estrada

2025 nos manteve em movimento. Além de nossa própria programação, Oscilar mostrou presença em 16 grandes conferências e eventos do setor ao redor do mundo: compartilhando ideias, aprendendo com clientes e passando tempo com a comunidade de risco pessoalmente.

Algumas destaques:

Money20/20 EUA (Las Vegas)

Neha participou de dois painéis de casa cheia — um sobre fraude em stablecoin, outro sobre deepfakes e identidade digital

Neha gravou um episódio de podcast com Jason Mikula (Fintech Business Weekly) com uma audiência ao vivo

Saurabh também gravou um episódio de podcast: Além do Hype: O que Faz uma Verdadeira Empresa de IA

Um prêmio Banking Award do Money20/20 em Identidade, AML & KYC

Money20/20 Europa (Amsterdã)

Selecionado para Startup Spotlight, apresentado por nosso CPO Saurabh Bajaj

Co-organizou a Recepção de Empréstimo & Risco com This Week in Fintech

Também passamos tempo no Fintech Meetup EUA, ACAMS (Hollywood, Las Vegas, Boston), Fintech NerdCon (Miami), Febraban Tech (São Paulo), Nacha Smarter Faster Payments, e na Cúpula de Política AFC.

Onde você nos encontrará em 2026

Sim, estamos fazendo tudo de novo (mas ainda maior). Aqui está o que está na agenda até agora.

Semana Fintech México (TWIF) — 23–27 de fevereiro, Cidade do México

Fintech Meetup EUA — 30 de março–1 de abril, Las Vegas (Neha falando)Clube de Combate à Fraude — 14–15 de abril, Charlotte

Nacha Pagamentos Mais Inteligentes e Rápidos — 26–29 de abril, San Diego

Money20/20 Europa — 2–4 de junho, Amsterdã

Febraban Tech — 24–26 de agosto, São Paulo

Fintech Meetup Europa — 6–8 de outubro, Lisboa

Money20/20 EUA — 18–21 de outubro, Las Vegas

Também continuaremos a hospedar RiskCons e eventos virtuais ao longo do ano. Junte-se à nossa comunidade para saber onde estaremos a seguir. Mais datas estão por vir em breve!

Conversas (online) que importaram

Nem toda ótima conversa em 2025 aconteceu pessoalmente. Também reunimos a comunidade virtualmente, hospedando sete webinars ao vivo e duas sessões ao vivo no LinkedIn que foram práticas, sinceras e genuinamente divertidas. Essas sessões abordaram as questões que as equipes de risco estão ativamente enfrentando, apresentando exemplos reais, opiniões fortes e muita participação da audiência.

Além da Inteligência Tradicional de Dispositivos: O Futuro da Identidade Digital & Prevenção de Fraude

O Relacionamento Banco-Fintech: O Que Ninguém Conta

Detecção e Resposta em Tempo Real: Aproveitando IA e Automação para Gerenciar Risco de Stablecoin

A Crise Crescente de Fraude no Relatório de Crédito

O que Há de Novo em KYC

IA na Fraude: Redefinindo Estratégia & Operações na Era GenAI

A Batalha pela Economia de Agentes: Qual Padrão Vencerá?

Perdeu ao vivo? Não se preocupe, você pode sempre replays nossos webinars sob demanda. Espere mais!

2026: Construindo a partir do impulso

Entramos em 2026 com tração real e uma direção clara. O trabalho à frente se baseia diretamente no que foi lançado, ampliado, e sustentado em 2025.

Uma olhada no que está por vir

Novos agentes de IA ampliando automação em mais processos de risco

Modelos mais inteligentes e adaptativos projetados para abordar padrões emergentes de fraude

Infraestrutura global expandida, incluindo regiões adicionais de centros de dados

Novas capacidades para comércio agentic e pagamentos impulsionados por IA

Continuação da expansão pela América Latina, Europa e Oriente Médio

Suporte para novos requisitos de monitoramento de fraude ACH, através de nossa parceria com a Nacha

Soluções específicas da indústria adaptadas para verticais de alto crescimento

Junte-se à equipe que está construindo o futuro do risco

Demos as boas-vindas a muitos novos Oscilarians em 2025, nas áreas de engenharia, ciência de dados e entrada no mercado e ainda estamos crescendo. Se construir sistemas financeiros mais seguros e inteligentes soa como seu tipo de trabalho, adoraríamos conhecê-lo.

O impulso é real

2025 foi um ano de execução. Aprofundamos relações com instituições financeiras globais, recebemos reconhecimento de alguns dos avaliadores mais rigorosos do setor, e passamos o ano em estreita conversa com líderes de risco moldando o que vem a seguir.

À medida que a Decisão de Risco em IA em tempo real passa de experimento para expectativa, Oscilar está focada nos fundamentos: construir sistemas dos quais as equipes possam depender: em escala, sob pressão e nos ambientes onde realmente importa.

Obrigado aos nossos clientes, parceiros e colegas pela confiança por trás desse progresso. Estamos ansiosos por mais um ano de construção, aprendizado e elevação do padrão de como o risco é gerenciado.

Para cima e em frente!