Última actualización: 23 de diciembre de 2025

La investigación de compras de ChatGPT es una nueva función del gigante de la IA de $500 mil millones, OpenAI, que permite que agentes de IA dentro de ChatGPT investiguen productos, comparen opciones y guíen decisiones de compra de principio a fin a través de una única interfaz conversacional.

Esta capacidad representa la forma temprana del comercio agéntico, un modelo en el que los sistemas de IA realizan tareas que tradicionalmente desempeñaban los usuarios a lo largo de la búsqueda, comparación y compra. Los lanzamientos recientes de OpenAI, Google y Perplexity AI sugieren que la inteligencia artificial está yendo más allá de simplemente asistir en el recorrido de compras y pronto se convertirá en la principal interfaz para descubrir y seleccionar productos.

Aunque se presenta como una mejora de producto, el movimiento representa algo mucho más significativo. La investigación de compras de ChatGPT marca el inicio de un nuevo paradigma comercial. En lugar de navegar por múltiples sitios web, filtros y anuncios, los consumidores pueden depender de agentes de IA para evaluar opciones y ofrecer recomendaciones, colapsando el embudo tradicional de comercio electrónico en un único flujo de trabajo mediado por IA e introduciendo nuevos desafíos técnicos y de confianza para la infraestructura comercial existente.

Resumen

Las herramientas de investigación de compras de ChatGPT afirman el auge del comercio agéntico, donde los agentes de IA investigan, recomiendan y ejecutan compras de forma autónoma

La integración de OpenAI con Stripe permite transacciones completamente impulsadas por IA, que se extienden más allá del descubrimiento de productos hasta la ejecución de pagos y cumplimiento

El comercio agéntico colapsa el embudo tradicional de comercio electrónico, omitiendo la búsqueda, anuncios y páginas de productos tradicionales, reformulando cómo se descubren y eligen las marcas

Los pagos autónomos introducen nuevos riesgos de fraude, autorización y confianza que los sistemas centrados en humanos no están diseñados para manejar

Ganar en el comercio agéntico requiere datos de productos legibles por máquina, procesos de pago compatibles con agentes y infraestructura de riesgo nativa de IA como Oscilar

Cómo funcionan las capacidades de compras con IA de ChatGPT

En su esencia, la capacidad de compras de ChatGPT funciona como un agente comprador conversacional, involucrando a los usuarios en el descubrimiento de productos conversacionales mientras obtiene datos de precios, reseñas y disponibilidad en tiempo real de la web.

Cuando un usuario expresa intención de compra, el sistema puede:

Interpretar restricciones de compra en lenguaje natural como precio, calidad y velocidad de entrega

Comparar productos utilizando datos de precios, reseñas y disponibilidad en tiempo real

Recomendar opciones optimizadas para las preferencias expresadas por el usuario

Avanzar hacia el proceso de compra sin necesidad de búsqueda, navegación o comparación manual tradicional

Esta experiencia se basa en la capacidad e Instant Checkout de la compañía, desarrollada en asociación con Stripe, que permite a los agentes de IA pasar de la investigación de productos al pago a través de APIs de pago programables.

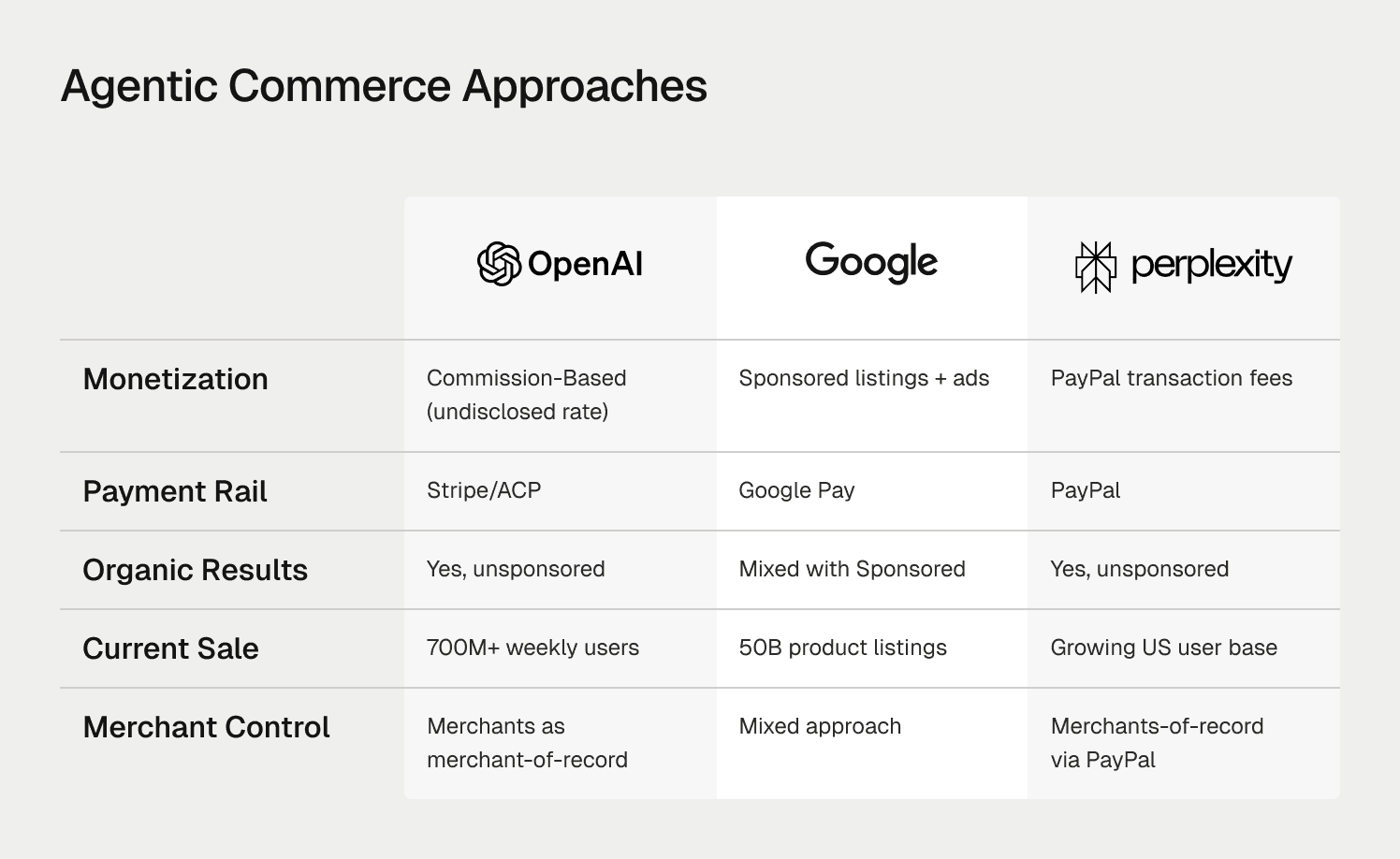

Críticamente, OpenAI ha declarado que los resultados de compras son orgánicos y no patrocinados, diferenciando el enfoque de ChatGPT de los mercados y motores de búsqueda impulsados por anuncios. Esto es importante porque posiciona a ChatGPT como una interfaz transaccional, no solo una capa de descubrimiento.

Por qué el comercio agéntico rompe el embudo tradicional de comercio electrónico

El comercio electrónico tradicional depende de un embudo lineal y de múltiples pasos: búsqueda, anuncios, páginas de productos, comparación y compra. El comercio agéntico colapsa toda esta secuencia en un flujo de decisiones mediado por IA único.

Cuando agentes de IA como ChatGPT manejan la evaluación y selección de productos, las consultas comerciales de alta intención nunca aparecen en los resultados de búsqueda o mercados. En cambio, las decisiones de compra se toman dentro de interfaces conversacionales, donde:

Las clasificaciones SEO importan menos que los datos de productos legibles por máquina y atributos estructurados

La influencia de la publicidad cede ante la utilidad, la relevancia y la certeza del cumplimiento

La atribución basada en clics desaparece, incluso cuando las marcas influyen significativamente en el resultado

El cambio al comercio agéntico altera fundamentalmente cómo se descubren, evalúan y eligen los productos, y la infraestructura que permite esta transformación ya está tomando forma.

Las redes de pago y plataformas, incluidos Visa, Mastercard, PayPal y OpenAI en asociación con Stripe, están construyendo marcos de tokenización y APIs de pago programables diseñados específicamente para transacciones iniciadas por agentes de IA. Morgan Stanley Research proyecta que el impacto económico del comercio agéntico podría alcanzar los $385 mil millones en Estados Unidos para 2030, representando el 20% de la actividad de comercio electrónico.

Esto simultáneamente amenaza las bases económicas de la publicidad en búsqueda y el comercio basado en mercados, mientras crea nuevas oportunidades para las marcas que son legibles por IA, compatibles con agentes y de confianza por sistemas autónomos.

La carrera armamentista de compras con IA: Protocolos de comercio agéntico de Google y Perplexity

OpenAI no está operando en aislamiento. Google, ahora la tercera empresa más valiosa del mundo, en gran parte gracias a sus inversiones en IA, ha lanzado sus propias experiencias de compras impulsadas por IA que combinan la búsqueda conversacional, el proceso de compra autónoma y llamadas iniciadas por IA a minoristas locales para verificación de inventario en tiempo real. Estas capacidades son impulsadas por el Graph de Compras de Google, que agrega datos de más de 50 mil millones de listados de productos, brindando a sus sistemas de IA un contexto comercial profundo y en tiempo real.

Mientras tanto, Perplexity AI se ha asociado con PayPal para habilitar compras dentro del chat. Esto posiciona a Perplexity más como una interfaz de IA centrada en transacciones que como un motor de investigación tradicional, priorizando la velocidad, la finalización y la mínima fricción del usuario sobre el análisis comparativo profundo.

¿Pueden los sistemas de riesgo diseñados para humanos proteger el comercio impulsado por IA?

A medida que el capital fluye hacia la infraestructura de comercio agéntico, una pregunta crítica de seguridad sigue en gran parte sin respuesta: ¿cómo se asegura una transacción cuando ninguna de las partes es humana?

La misma automatización que hace que las compras con IA sean rápidas y sin fricciones también crea nuevas superficies de ataque. Cuando los agentes de IA ejecutan compras de manera autónoma, las señales de detección de fraude tradicionales pierden efectividad. La biometría de comportamiento, el análisis de sesiones y la revisión manual asumen la intención y patrones de interacción humanos que simplemente no existen en transacciones ejecutadas por máquinas.

Los actores malintencionados ya están experimentando con indicaciones adversas y técnicas de manipulación diseñadas para coaccionar agentes de IA a compras no autorizadas, escalación de privilegios o redirección de pagos.

En el comercio agéntico, la naturaleza misma del fraude cambia, de hacerse pasar por personas a explotar la lógica de decisión de las máquinas.

La exposición al fraude de $385 mil millones

Si los pagos agénticos alcanzan los $190 a $385 mil millones en EE.UU. para 2030, como proyecta Morgan Stanley Research, incluso una modesta tasa de fraude se traduce en miles de millones de dólares en pérdidas. A esa escala, el riesgo deja de ser un caso límite, para convertirse en una propiedad estructural del sistema.

Cuando los volúmenes de transacciones alcanzan cientos de miles de millones de dólares, incluso el fraude de baja frecuencia y baja fricción se compone rápidamente y sistemáticamente. Los agentes de compras autónomos operan continuamente, ejecutan compras repetitivas y optimizan por eficiencia, no por precaución. Esto hace que los pequeños vectores de explotación sean desproporcionadamente costosos a gran escala. Pero esto no es teórico, ya que los datos de adopción ya sugieren que la transición está en marcha.

Una parte significativa de los consumidores ahora investigan, comparan y completan compras a través de sistemas de IA, con una concentración temprana en comestibles y bienes de consumo envasados. Estas categorías amplifican la exposición porque combinan una alta velocidad de transacción, gasto recurrente y mínima revisión humana, creando condiciones ideales para el abuso automatizado.

El desafío se complica en entornos B2B, donde agentes autónomos pueden negociar contratos y ejecutar pagos por millones sin supervisión humana. Un solo bucle de decisión comprometido puede desencadenar pérdidas financieras en cascada a través de múltiples transacciones o proveedores.

Es precisamente por eso que la infraestructura de riesgo debe evolucionar en paralelo con las vías de pago, no después de la implementación. Por eso Oscilar está construyendo un sistema de detección de fraude y toma de decisiones de riesgo nativo de IA diseñado específicamente para el comercio iniciado por máquinas. Oscilar se enfoca en modelar el comportamiento de los agentes, identificando patrones de decisión anómalos en tiempo real y aplicando controles de riesgo adaptativos a los flujos de transacción autónomos.

A medida que los agentes de compras se proliferan, las organizaciones que prosperan serán aquellas que integren una gestión de riesgos inteligente directamente en su infraestructura agéntica en lugar de añadir herramientas de fraude heredadas como un añadido.

A la escala del comercio agéntico, la prevención del fraude se convierte en un requisito previo para el crecimiento, no una preocupación operativa secundaria.

El problema no resuelto de autenticación y autorización en el comercio agéntico

La detección de fraude es solo parte del desafío. La autenticación y autorización siguen siendo problemas fundamentalmente no resueltos a nivel de protocolo.

Cuando un agente de IA afirma representar a un consumidor, ¿cómo verifica el comerciante que la autorización es válida, actual y está correctamente delimitada? Cuando dos agentes negocian un contrato B2B, ¿qué constituye el consentimiento vinculante y cómo se aplica?

Estas no son preocupaciones hipotéticas, son decisiones arquitectónicas activas que se están tomando ahora mismo y que determinarán si el comercio agéntico se convierte en un canal comercial confiable o en un vector de fraude sistémico.

Hasta que la autorización, identidad y responsabilidad se resuelvan a nivel de protocolo, la confianza seguirá siendo el factor limitante para el comercio autónomo a escala.

El futuro del comercio en una economía agéntica impulsada por ChatGPT

ChatGPT y otras herramientas de compras impulsadas por IA representan más que una nueva capacidad de producto, sino una redefinición estructural de cómo se descubre, decide y ejecuta el comercio.

Y las implicaciones para la tecnología financiera se extienden mucho más allá de las compras del consumidor. Los mismos sistemas que permiten compras de productos impulsadas por IA pronto facilitarán pagos B2B autónomos, decisiones de crédito dinámicas y negociaciones comerciales entre agentes.

Para las organizaciones de los sectores minorista, de pagos y servicios financieros, esto crea un doble imperativo estratégico: Desarrollar interfaces legibles por máquina e infraestructura compatible con agentes mientras construyen simultáneamente marcos de riesgo, autorización y fraude lo suficientemente sofisticados para asegurar transacciones completamente autónomas a escala.

Las organizaciones que tendrán éxito serán aquellas que reconozcan que estamos presenciando no solo la evolución de la búsqueda o los pagos, sino la reestructuración fundamental de cómo ocurren las transacciones económicas y cómo se impone la confianza en una economía mediada por máquinas.

Las organizaciones que ganan en este entorno serán aquellas que:

Construyen datos de productos, precios y políticas legibles por máquina

Habilitan pagos y procesos de pago compatibles con agentes y programables

Incorporan controles de riesgo, autorización y fraude nativos de IA directamente en la infraestructura de transacciones

El comercio agéntico es el futuro. Pero solo si podemos confiar en él.